High Bandwidth Memory (HBM) is predicted to soar more than twofold in natural terms in the current year, according to analytics firm TrendForce. Gartner representatives focus on the monetary turnover of this market segment, predicting it to double in the next year. It implies that the revenue of HBM producers will surge from 2 to 4.98 billion dollars, growing almost two and a half times compared to last year.

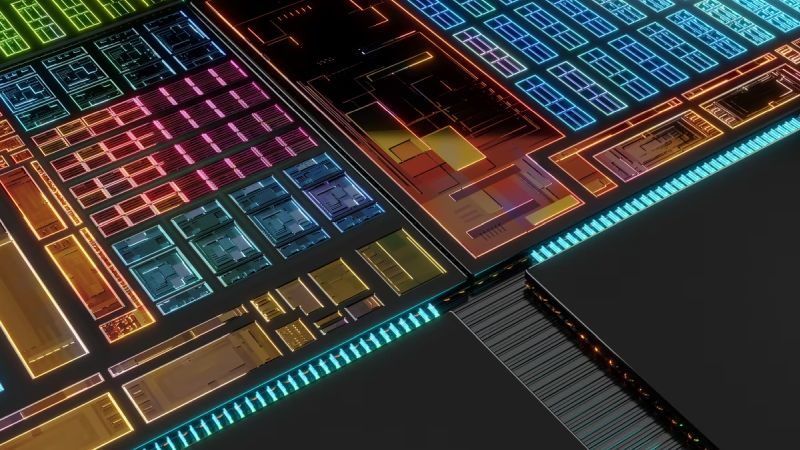

This forecast has been published by Taiwanese outlet, Business Times, citing data from Gartner. In this year itself, computation accelerators that use HBM3e type memory will be unveiled in the market. NVIDIA will introduce H200 and B100, while AMD will launch Instinct MI300X accelerators. HBM3e type memory suppliers are all set to cater to their clients from the second quarter of this year.

The rapid market development and healthy profit will assist Samsung Electronics and Micron Technology in reclaiming a portion of their HBM segment’s position from SK hynix, a dominant player in the field. Intensified competition will not only lead to an increase in supply volume, but can also induce a decline in prices.

Currently, Taiwanese manufacturers are planning to participate indirectly in HBM production even though Nanya, for instance, has experience in producing such memory. Equipment supplier Licheng plans to launch solutions for testing and packaging HBM type memory stacks, and the corresponding equipment will commence production by the end of this year. Creative is collaborating with TSMC and SK hynix to apply its GLink-2.5D interface in producing HBM3 memory chips in a CoWoS package. Smaller companies are also expressing interest in supplementary technologies.