Boosted largely by high demand for the HBM3 memory it supplies to NVIDIA’s artificial intelligence systems, last month SK hynix managed to become South Korea’s second-largest company by market capitalization. This factor also aided SK hynix in closing its last quarter with an operating profit for the first time in over a year.

Although the previous year was difficult for the memory market as a whole, the HBM segment managed to stand out considering its favourable market conditions for manufacturers. Manufacturers like Micron and Samsung seek to obtain a spot in the HBM memory supply chain for NVIDIA’s needs, but SK hynix has remained a sole supplier in this scene, accruing profits. Despite the previous four quarters being loss-making periods for the company, it ended the past quarter with an operating profit of $259 million. Nonetheless, it was not able to prevent the company from net losses of $1 billion. In a year-on-year comparison, SK hynix’s revenue for the fourth quarter increased by 47% to $8.5 billion. In total, the company’s revenue for the year reached $24.5 billion. However, the last quarter witnessed a negative profit margin of -12%, and the overall year yielded -28%. SK hynix’s net losses for the year were $6.84 billion.

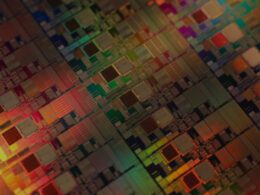

In the previous quarter, SK hynix was able to increase its DDR5 shipments by more than four times, and HBM3 shipments grew by over five times. This year, the company aims to begin mass production of HBM3E and proceed with HBM4 memory development. With NVIDIA continuing to dominate the computing accelerator segment, SK hynix can capitalize on its market advantage until the end of the current fiscal half-year. The server segment will ramp up DDR5 shipments, and the mobile sector will benefit from the brand’s LPDDR5 memory. Also, high-capacity MCRDIMM memory modules will be allocated to the former, while the latter will implement the LPCAMM2 form factor. The 10-nm DDR5 and LPDDR5 chips will be produced at SK hynix’s plant in Wuxi, China.

In the slowly recovering NAND segment, SK hynix aims to focus on premium storage devices. The company’s priority for the current year is maintaining stability and curbing capital expenditure, although no cuts are planned in priority areas. Flash memory prices began to rise during the past quarter, and the situation on stock balances should normalize within the next half-year. In the case of DRAM memory, normalization is expected in the first half of the current year. If strategically important business directions are supported by increasing capital expenditures, the production of obsolete products will decline. According to SK hynix representatives, the demand for DRAM and NAND will increase by 15–19% this year.