ASML, a major supplier of lithographic scanners, reported a significant 39% of its total revenue coming from the Chinese market in its recent quarterly conference. Lam Research, a notable American firm that supplies silicon wafer etching equipment, stated that Chinese clients constituted 40% of its revenue last quarter.

According to South China Morning Post, Lam Research’s revenue from China was 26% in Q2 of the previous year. It reached a high of 48% in Q3 before falling to 40% in Q4. Remarkably, a year ago, China and South Korea were tied at 22% each in contributing to Lam Research’s total revenue. Over time, China’s influence has grown, with South Korea accounting for only 19% of the fourth quarter’s total revenue, while Japan stood third with a 14% share.

As previously reported, ASML gained 39% of its total revenue from China in the last quarter, outperforming Taiwan, Japan, and South Korea. In third quarter, China’s share in ASML’s revenue was even higher, at 46%. The intensifying US sanctions are seemingly affecting the supply of lithographic equipment to China, which began in the fall of last year. For 2023, the share of ASML’s revenue from China reached 29%, a significant increase from 14% in 2022. Last year, ASML had to fulfill orders placed before the end of 2022, as specified by AMSL management.

Separately, China’s customs statistics showed a 47% decrease in lithographic systems imported from the Netherlands from September to December. In monetary terms, the import decreased by 72% to $58.8 billion. On the contrary, the supply of silicon wafer cleaning equipment to China grew by 667% to $3.85 billion, indicating that market trends are not unidirectional.

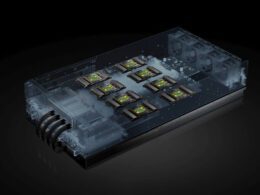

Analysts note that ASML’s overall revenue growth last quarter can be attributed more to the HBM memory market. As the artificial intelligence systems boom, HBM manufacturers are ramping up production and purchasing equipment. In this case, EUV scanners, which bring significant revenue to ASML due to their high cost, are required for HBM production.