This week, Nvidia Corporation, one of the world’s most valuable publicly traded companies, is expected to report its performance for the past fiscal quarter. Although the tech company experienced hurdles to increase its revenue in the previous quarter, analysts are ready to scrutinize these factors.

As Reuters explains, Nvidia’s shares have not yet scaled their historical peak, but assuming the quarterly report is favorable, they could do so this week. Since the beginning of 2023, the company’s share price has increased more than sixfold, earning it a spot among the top three world’s most expensive companies with capitalization exceeding $2.3 trillion. Since the start of the year, Nvidia shares have grown in price by 89%, raising sector-specific stock indexes. Its shares now constitute 5% of the S&P 500.

Analysts surveyed by LSEG predict that the quarter ending in April allowed Nvidia to boost its revenue by 242% to $24.6 billion. Predictions suggest that the revenue of the current quarter could increase by 97% year on year. They expect the company’s net profit to increase more than six times to $12.83 billion.

However, some analysts have expressed concerns about Nvidia’s partners’ ability to meet growing demand for computation accelerators. Experts suggest the production and packaging of chips for accelerators, including HBM type memory, might be insufficient. This constraint could limit Nvidia’s revenue growth. Moreover, the “high base” effect may unfavorably compare the current periods with the previous year’s rapid revenue growth.

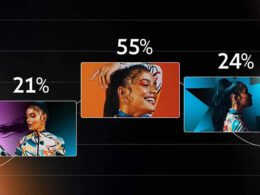

Secondly, US sanctions against China are potentially undermining the company’s regional revenue. While China accounted for 22% of Nvidia’s revenue in the third quarter of the last fiscal year, that has since dropped to 9%. This trend may have continued into the first quarter due to new sanctions imposed last fall.

Analysts estimate Nvidia’s profit margin in the first quarter at 77%. However, it may decline to 75.8% in the current quarter as the company is forced to spend more on HBM memory purchase due to rising market prices and Nvidia’s upgrade to more expensive and contemporary HBM3E memory.

In contrast, investors remain confident that Nvidia’s cloud customers will spend significantly on the company’s equipment to advance their computational infrastructure. Canalys forecasts a 20% increase in capital expenditures of cloud market players this year, following an 18% rise last year. Cloud giants find it challenging to switch to Nvidia accelerator alternatives. Firstly, Nvidia occupies most of the production capacity. Secondly, its accelerators are hard to outperform in speed. Thus, the company’s lead in the server market remains unthreatened.