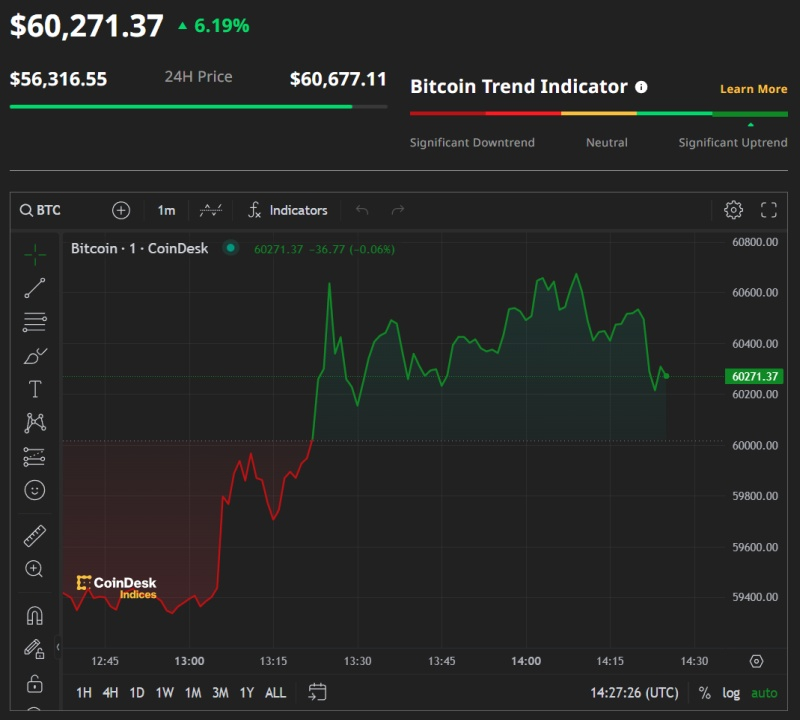

Bitcoin reaches $60,000 for the first time since hitting a record high close to $69,000 in November 2021. This year alone, the world’s largest cryptocurrency has appreciated by more than 40%, partly due to the successful launch of US-registered SPOT ETFs, which have garnered over $6 billion since their launch on January 11th, and partly due to the upcoming halving event, which cuts the reward for mining a block by half from 6.25 to 3.125 bitcoins.

“This is quite insane,” says Ryan Kim, head of derivatives at the primary broker for digital assets, FalconX. The value of Bitcoin has tripled since last year, rebounding after a 64% fall in 2022. This marks a remarkable comeback after a series of scandals and bankruptcies in the crypto industry raised questions about the viability of digital assets.

“The turnaround is all the more impressive in light of central banks signalling their intention to keep rates high for some time, undermining the theory that the next bull run in cryptocurrencies will be triggered by lower interest rates,” notes Dexterity Capital co-founder, Michael Safai.

In 2024, Bitcoin growth surpassed conventional assets such as stocks and gold. The rise of Bitcoin stirred speculative interest in smaller cryptocurrencies such as Ethereum and Dogecoin. Digital tokens are thriving even as investors lower expectations for laxer monetary policy this year, signalled by the rise in US Treasury bond yields.

The massive influx into bitcoin ETFs has prompted some industry observers to warn of an impending supply crunch as new coins from miners will not be able to meet demand. According to analysts, about 80% of bitcoins have not changed hands in the past six months, potentially exacerbating the situation and increasing price pressure.