Global Semiconductor Equipment Revenue Dips 2% YoY to $26.4 Billion, China Doubles Purchases

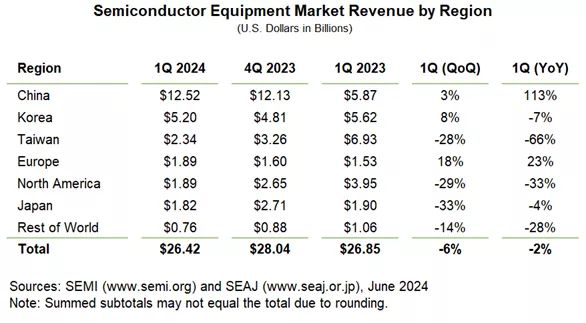

According to the latest statistics of the Semiconductor Equipment and Materials International (SEMI), global revenue from semiconductor equipment sales showed a slight dip by 2% year-on-year to $26.4 billion in the first quarter of 2024, and sequentially by 6%. However, Chinese chip manufacturers doubled their equipment purchases, now accounting for 47% of global expenditures.

Over $12 Billion Spent by Chinese Manufacturers on Chip-making Equipment

In absolute terms, Chinese manufacturers spent $12.52 billion on chip-making equipment in the first quarter of 2024, an increase of 113% compared to the same period last year. We note that by the fourth quarter of last year, Chinese spending on chip-making equipment had reached $12.13 billion, therefore the spending increased sequentially by only 3% in the first quarter of the current year. Chinese manufacturers are actively stockpiling equipment, prompted by the threat of increased sanctions and the need for import substitution in the semiconductor industry.

China Outperforms Other Big Buyers in Equipment Spend

A year ago, China barely outperformed South Korea in terms of chip-making equipment expenditure. Now, all of the major buyers combined (South Korea, Taiwan, Europe, North America, and Japan) barely surpass China’s total expenditure in this area. South Korea trails China by two and a half times with its $5.2 billion spending in the first quarter. In fact, Korean equipment buyers even reduced their expenses by 7% compared to the first quarter of last year.

Taiwan and Europe Show Significant Changes, North America and Japan Falter

Taiwan, among the largest buyers, reflected the most substantial negative dynamics by shrinking its expenditure by 66% to $2.34 billion. Europe, on the other hand, exhibited the second fastest growth rate after China, increasing expenditure by 23% to $1.89 billion. For North America, there was a one-third drop to $1.89 billion in Q1, putting it on par with Europe. Japan only slightly fell behind, with its spending trimmed down 4% to $1.82 billion. Other countries around the world curtailed these specific expenditures by 28% to $0.76 billion. Despite the current dip, SEMI management forecasts a return to growth in chip-makers’ purchasing expenditures in the coming months.