Chinese companies, such as Yangtze Memory Technologies Company (YMTC), are not just limiting their efforts to world class 3D NAND memory. Among them, CXMT, a leading local producer of DRAM, is preparing to start the production of HBM-type memory. This advanced memory technology is used in foreign-designed accelerators, part of artificial intelligence systems.

According to Nikkei Asian Review, CXMT has placed orders and begun receiving equipment for HBM memory production. The move is aimed at circumventing current trade regulations, as the U.S. and its allies do not yet regulate these types of equipment deliveries. Hence, this allows CXMT to procure these technologies from the U.S. and Japan beforehand, before any possible sanction implementations. Currently, CXMT does not possess HBM manufacturing technology, but seeks to equip itself in advance with the necessary hardware. Since last year, CXMT has been developing vertically-integrated DRAM microchip technology, similar in structure to HBM.

In addition, CXMT was able to purchase suitable equipment for less advanced DRAM microchips from a local Chinese supplier. Some American equipment providers received export licenses in mid-2023, allowing them to supply CXMT with their products. Market leaders Applied Materials and Lam Research are among these suppliers. Even so, the equipment they supplied to China will still comply with the U.S. export control rules effective from October 2022.

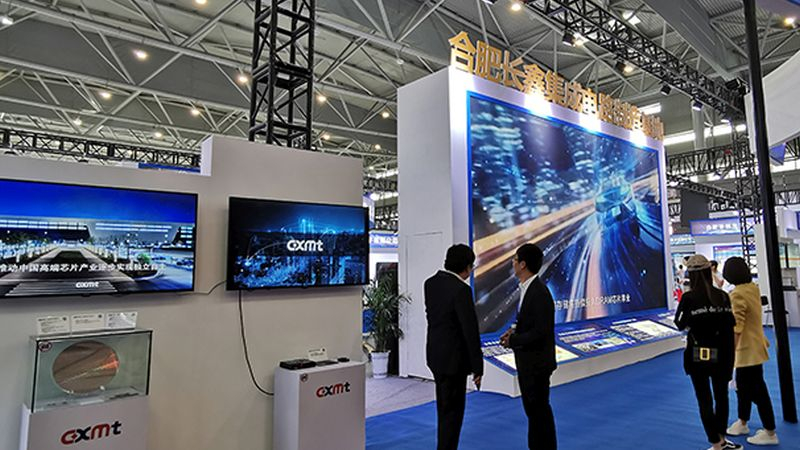

Established in 2006, CXMT announced last year the commencement of manufacturing LPDDR5-type memory for flagship smartphones, the first of its kind in the country. This product has received certification from companies such as Xiaomi and Transsion. Foreign competitors to CXMT have been producing similar memory since 2021. Although CXMT lags in technological development compared to companies like Micron and SK Hynix, it leads Taiwan’s Nanya Technology. Nevertheless, in global DRAM market CXMT accounted for less than 1% last year, with the trio of Samsung, SK Hynix, and Micron dominating at 97%.

In the HBM segment, South Korean companies SK hynix and Samsung dominated with 92% of the market share last year. Micron Technology, which joined the market later, held only 4-6% but showed aspirations to grow this figure. HBM production requires not only the equipment to process silicon wafers but also sophisticated packaging techniques for the finished microchips. Even if CXMT succeeds in producing HBM memory in full capacity, Counterpoint Research experts believe that it will mainly serve the domestic market.