In its latest quarterly report, Taiwan’s TSMC disclosed a decline in revenues and profits though the figures were better than investor expectations. The company witnessed a 1.5% reduction in revenue to $19.62 billion, while net profit fell by 19.3% to $7.56 billion. Regardless, the company projects at least a 20% growth in revenue for the current year.

Investor Focus: Revenue Growth

The main concern for investors is TSMC’s revenue prospects rather than its performance in the previous quarter or in 2023. The company plans to spend between $28 and $32 billion in capital expenditure this year. Furthermore, TSMC’s facilities in Japan will commence operations by the end of the year, with additional funds required for building two factories in Arizona and one in Germany. Despite generous subsidies from local authorities, TSMC will still face costs, amplified by the impacts of inflation.

Performance Trends

Interestingly, the quarterly revenue slightly surpassed TSMC’s own forecast ($19.62 billion versus $19.6 billion). The company highlighted a 14.4% sequential rise in revenue, signalling a renewed demand for semiconductor components. TSMC clients particularly showed increased interest in the company’s 3-nanometer (nm) components. The company’s Chief Executive Officer, C.C. Wei, expressed optimism about a positive revenue trajectory this year, stating: “Our business has reached the bottom in year-on-year comparison, and we expect 2024 to be a year of healthy growth for TSMC.” Total annual revenue in the previous year decreased by 4.5% to $69.3 billion. TSMC shipped almost 3 million 300mm silicon wafers in the last quarter, a 20.1% year-on-year decrease.

Future Insights: Projected Revenue Growth

Going forward, TSMC hopes to boost its revenue by 20-25% this year. C.C. Wei, expected to become the chairman of the company’s board of directors soon, believes TSMC is well-positioned to dominate the majority of the semiconductor components market for artificial intelligence systems. In the last year, TSMC’s profit margin slipped from 59.6% to 54.4%, with its operating profit rate declining from 49.5% to 42.6%.

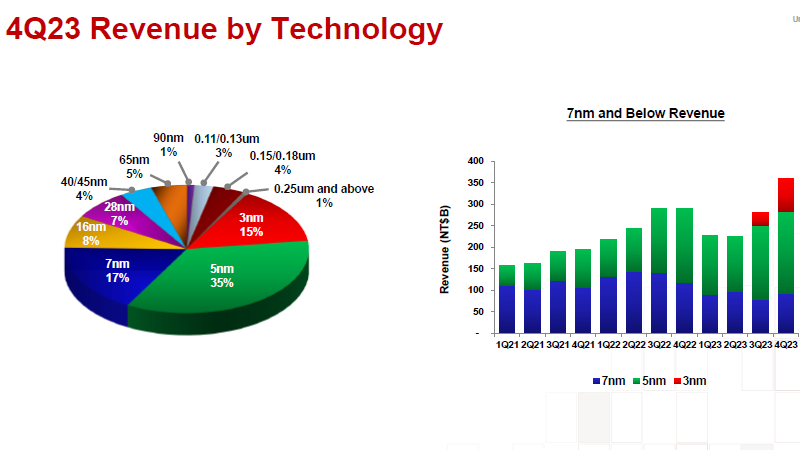

Technology Sales Breakdown

Revenue from 3-nm products increased from 6% to 15% between the third and fourth quarters. Conversely, the 5-nm process’ revenue share decreased from 37% to 35%, while the 7-nm process slightly increased its share from 16% to 17%.

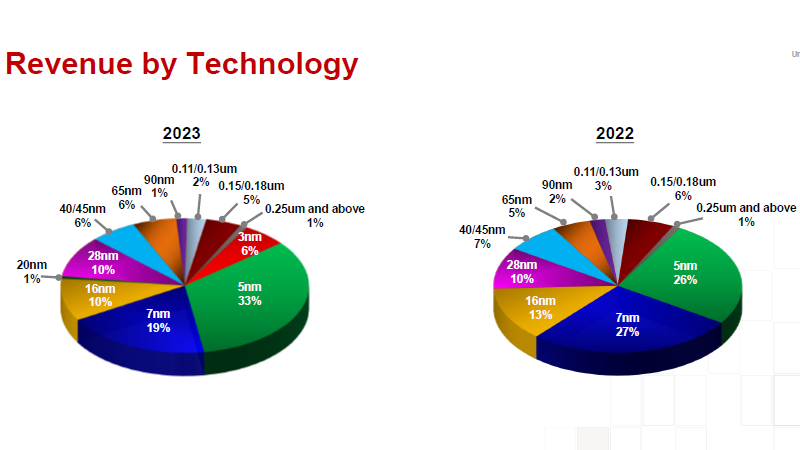

Industry Segment Revenue

Looking at the 2023 full-year results, the 3-nm technology accounted for only 6% of the company’s revenue, the 5-nm process contributed exactly one-third, and the 7-nm process fell from 27% the previous year to 19%. Significantly, the 16-nm process only brought in 10% compared to 13% in 2022.

Geographical Revenue Breakdown

In a geographical context, North America contributed a stable 68% of TSMC’s annual revenue, while Asia Pacific fell from 11% to 8%. However, Japan, Africa, Middle East and Europe each gained one percentage point, from 5% to 6% each.