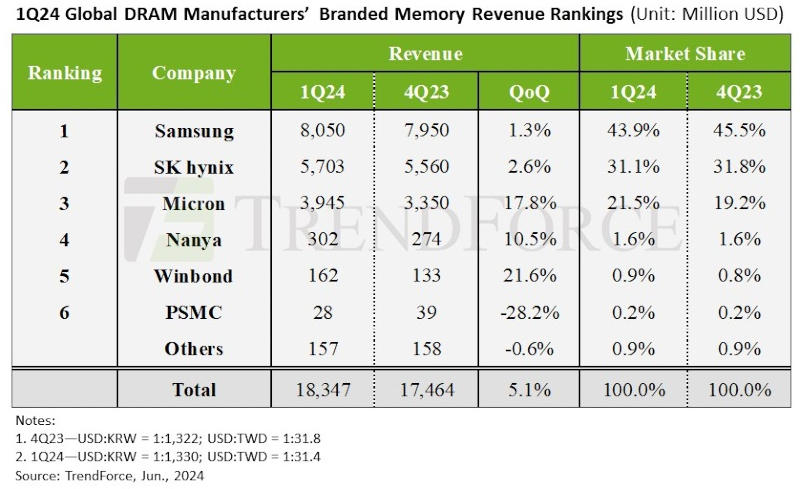

Global DRAM Revenue Rises by 5.1% in Q1

The worldwide DRAM industry showed a 5.1% revenue uptick in Q1 as compared to the same time last year, reveals analytical firm TrendForce. Industry revenues for this period were pegged at $18.35 billion, a growth fueled by rising contract prices for primary products. The increase in price dynamics surpassed Q4 2023 results.

DRAM Market’s Q1 Performance

In the traditionally low-performing Q1 period, the top three suppliers experienced a drop in shipments. Additionally, finished product manufacturers encountered high stock levels, leading to further purchase volume reductions. However, the Average Selling Price (ASP) remained high due to a rise in contract prices in Q4 2023. The mobile DRAM segment showed the most significant price growth thanks to strong Chinese smartphone sales. Meanwhile, price growth in the consumer segment was relatively low as manufacturers work to clear existing inventory.

Despite weak consumer demand, it is anticipated that main supplier shipments will increase following traditional seasonal trends in Q2. Consequently, some OEM manufacturers have begun agreeing to higher-than-expected prices, with contract prices predicted to rise by 13-18% in Q2.

Leading Players’ Q1 Performance

Samsung’s revenues showed a quarterly growth of 1.3% to $8.05 billion. Nonetheless, the company’s market share dropped by 1.6% to 43.9%. Samsung managed to maintain a leadership position, as a strategy aimed at a 20% average price increase effectively offset a definite percentage decline in shipment volumes. This demonstrates a pricing over volume orientation.

SK hynix, the second-place holder, experienced quarterly revenue growth of 2.6% to $5.7 billion. The company’s market share fell by 0.7% to 31.1%. The ASP indicator increased by 20%, offsetting a decrease in shipment volumes in the same vein as Samsung.

Micron observed the most significant quarterly revenue increase of 17.8%, giving it a revenue of $3.95 billion. The company claimed an additional 2.3% of the market share, placing it at 21.5%. Despite a 4-5% drop in shipments, Micron increased ASP by 23%, thereby outperforming its two Korean competitors. Thanks to an aggressive pricing strategy and high DRAM server shipments to large American clients, Micron assured itself of high performance levels. For Q2, while Samsung anticipates growth ranging from low to high single digits, SK hynix projects average single-digit growth, but Micron is preparing for a slight decline.

Taiwanese Manufacturers’ Q1 Performance

Among Taiwanese manufacturers, Nanya demonstrated a low single-digit percentage increase in Q1 shipments, attributed to stock replenishments due to price increases and slow consumer DRAM sales recovery. The company showed a high single-digit increase in ASP, leading to a 10.5% bump in its revenues to $302 million.

Winbond did not raise contract prices in Q1 but did show high shipment volumes, resulting in a 21.6% revenue increase to $162 million. PSMC’s revenue calculation primarily includes its own DRAM products and does not account for its semiconductor business. Despite a recovery in capacity utilization, the company reported a 28.2% decline in Q1 DRAM revenues to $28 million due to predominantly low-cost DRAM product shipments and reduced production and shipment days during the holiday season.