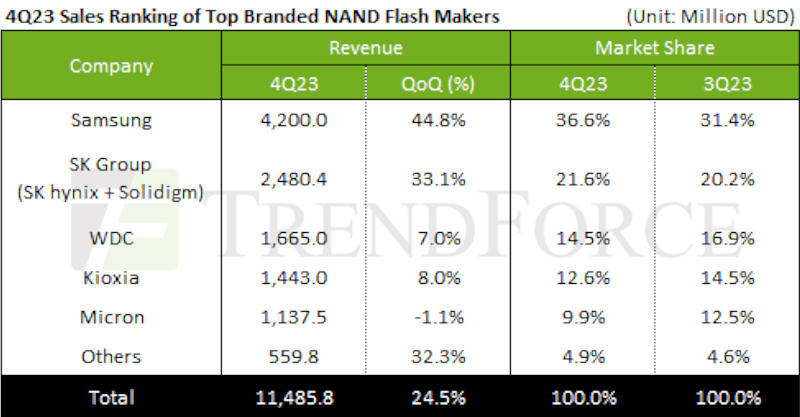

In the fourth quarter of 2023, the worldwide NAND flash-memory production industry recorded a 24.5% increase in revenues, reaching $11.49 billion in comparison to the previous quarter. This surge was largely due to stabilisation in product demand towards the end of the year, facilitated by promotional campaigns, and a surge in component orders.

Predicted Growth for Q1 2024

Analysts at TrendForce predict that the revenue growth in the NAND chips segment will continue into the first quarter of 2024. Despite traditionally weaker seasonal performance, a 20% growth is anticipated, driven by customers increasing their order volumes to avoid potential supply shortage and expenditure growth. Contract prices for NAND chips are expected to rise by an average of 25%.

Top Players in the NAND Chip Segment

Samsung continued to lead the NAND chip segment largely due to an increased demand for servers, laptops and smartphones. While the Korean manufacturer was unable to fulfill customer’s orders entirely, it managed to ramp up delivery volumes by 35% quarter-on-quarter. The average sale price (ASP) went up by 12%, contributing to Samsung’s segment revenue hitting $4.2 billion, marking a 44.8% increase from the previous quarter. SK Group (SK hynix and Solidigm) witnessed a 33.1% revenue growth, reaching $2.48 billion.

Performance of Other Key Players

Despite a 2% decline in delivery volumes, Western Digital achieved a 10% increase in ASP. This led to a 7% increase in the company’s NAND production subsector revenue, hitting $1.67 billion. The substantial growth in SSD retail market deliveries resulted in the inventory level plummeting to a four-year low. Kioxia also saw increased customer orders in the PC and smartphone segments, which boosted its revenue by 8% to $1.44 billion in Q4.

Pricing Trends and Future Expectations

In 2023, the NAND memory pricing faced a hurdle due to oversupply. However, Q4 saw an almost 10% surge in prices. In a bid to augment profitability, Micron reduced delivery volumes by 10%, resulting in a 1.1% revenue reduction from the previous quarter, bringing it down to $1.14 billion. The American company forecasts a 15–20% surge in NAND memory demand this year, emphasising the need for constant capacity control to balance demand and supply and maintain industry profitability.