Micron Technology: HBM Demand May Drive Up Prices For DDR4 and DDR5

After enjoying about four months of stability, the prices of DDR4 memory chips are at risk again, owing to an imbalance in supply and demand for High Bandwidth Memory (HBM) chips. Market analysis firm TrendForce notes that both DDR4 and DDR5 chips are manufactured in the same facilities as HBM chips, and as demand grows for HBMs, available production capacity reduces for DDR4 and DDR5. As a result, prices for these memory types could rise between 5-10% in the current quarter.

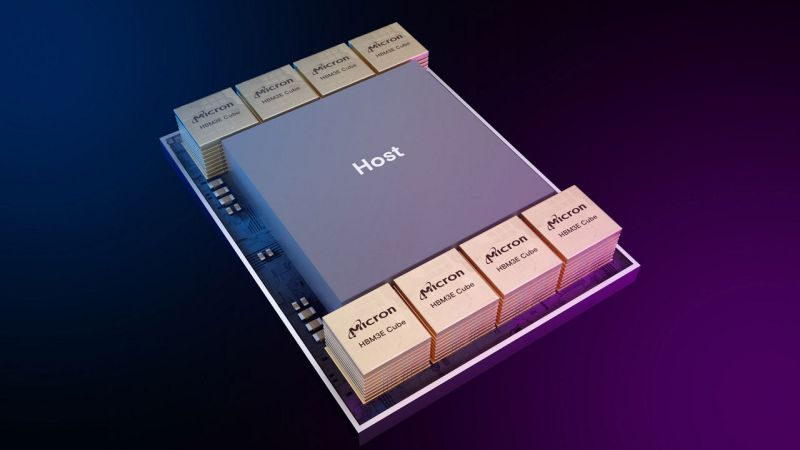

This follows recent reports by Nikkei of memory suppliers’ intentions to increase DRAM prices by 5 or 10% compared to the first quarter. Experts from TrendForce explain that at this stage, the key driver for DDR4/DDR5 price increases is the shortage of capacity for HBM production. Producing HBM chips requires more silicon wafers, invites a higher level of wastage, and takes up more production resources compared to DDR memory. In an attempt to capitalize on the more profitable HBM market, companies are shifting DRAM production lines, inadvertently reducing DDR output and creating conditions for price inflation.

Regarding the HBM segment, the pace of new facility construction will largely depend on its profitability. Current HBM production quotas at major suppliers have already been allocated until the end of this year, and for a significant part of next year. New facilities won’t be operational until sometime next year. Meanwhile, Nvidia’s HBM3E-equipped accelerators are entering the market, further increasing demand for these specific chips. These factors combine to create a potential rise in the prices of other DRAM types and a potential supply shortage.