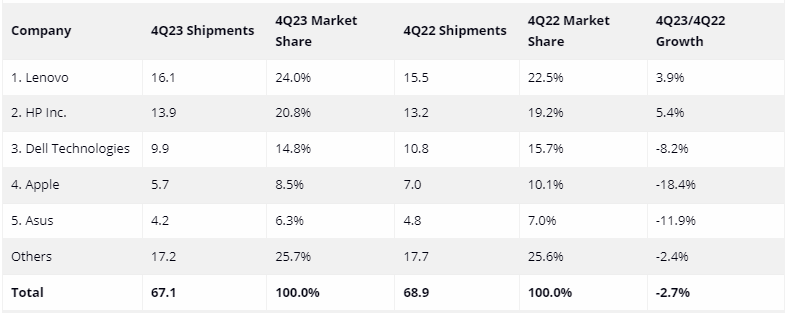

Preliminary results of the 2023 fourth quarter and the entire year PC market have been released by IDC analysts, pointing out various contradictory trends. On the one hand, global PC shipments shrank by 2.7%, down to 67.1 million units, marking the worst seasonal result since the fourth quarter of 2006. On the other hand, these results are proving to be better than expected. IDC foresees an upsurge in the personal computer market for this year.

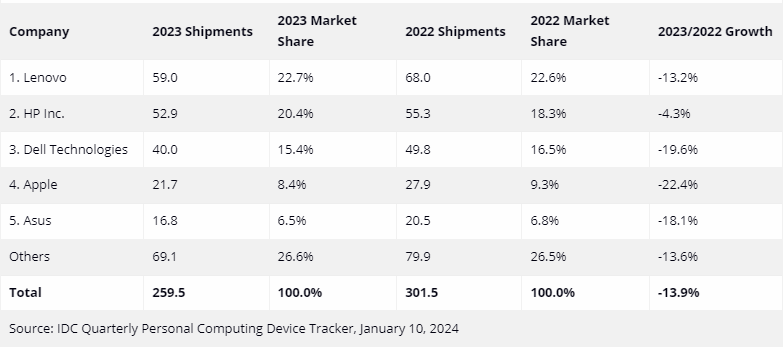

Last quarter marked the eighth consecutive period of decreasing PC shipments, registering as the worst fourth quarter since 2006. Preliminary figures for the year indicate that PC shipments dropped by 13.9% to 259.9 million units. The preceding year had a sharper decrease at 16.5%. This trend is attributed to the culmination of extensive computer reserves during the pandemic period, which will necessitate future updates.

According to IDC representatives, of all high-tech products, it is the PC category that experienced the most extreme ups and downs over the past four years. In 2024, commercial demand for PCs is expected to grow due to the completion of Windows 10’s life cycle. This growth is also forecasted to be propelled by new processors supporting artificial intelligence system acceleration functions. However, IDC experts believe that the gaming segment should not be overlooked.

If we consider the Q4 market dynamics by participant, Lenovo consistent managed to remain the leader. With a year-on-year increase of its market share from 22.5% to 24%, it boosted its shipments by 3.9%. HP Inc. ranked second and saw its market share grow from 19.2% to 20.8% with shipments up by 5.4%. The other three leading PC manufacturers did not fare so well in the last quarter. Dell took third place despite an 8.2% decrease in shipments, Apple saw a sharp drop of 18.4%, and Asustek, in fifth place, decreased its shipments by 11.9%. Other PC manufacturers, accounting for no more than 25.7% of the market, also decreased their product shipments by 2.4%. Overall, the global PC market contracted by 2.7% year-on-year in the fourth quarter to 67.1 million units.

Over the year, all market participants saw a negative shipment dynamic. Lenovo took the top spot with a slight decrease of 13.2%, and a 22.7% market share. HP Inc., in second place, best resisted the decrease with a 20.4% market share and a reduction in shipment volumes of 4.3%. Dell Technologies, held onto third place with a 15.4% market share despite a 19.6% decrease in shipments. Apple recorded the steepest drop at 22.4%, but still maintained a market share of 8.4% and fourth place. Asustek lost 18.1% in shipments, retaining a 6.5% market share and the fifth place. Total, 2023 PC shipments overall decreased by 13.9% to 259.5 million units, based on IDC statistics.