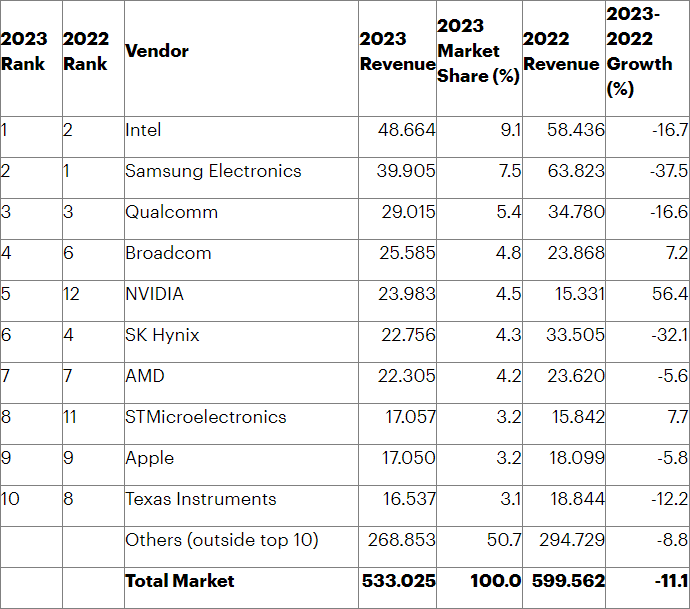

As the semiconductor market feels the ebb of the economic tide coming to a close, analysts from Gartner relay preliminary figures that encapsulate not only the past quarter but the entirety of 2023. Intel has soared past Samsung Electronics on the revenue leaderboard following a two-year hiatus, while NVIDIA makes its debut in the top five due to the boom in artificial intelligence systems.

According to Gartner’s dissection, the semiconductor market’s revenue tally for last year diminished by 11.1% to $533 billion. The results were largely influenced by cyclical fluctuations and an unprecedented challenge within the memory segment. Among the 25 major semiconductor suppliers, only 9 recorded a revenue hike throughout 2023. Conversely, 10 experienced a double-digit percentage revenue slump. Significantly, the revenue of the 25 leading semiconductor suppliers accounted for 74.4% of the total market revenue, reflecting a 14.1% dip from the previous year.

Samsung Electronics, the top memory manufacturer, suffered a severe hit due to low product prices in 2023. Its revenue shrunk by 37.5% to $39.9 billion. Consequently, after having led for two years, Samsung slipped to second place. Intel, after a 16.7% decrement in its revenue to $48.7 billion, emerged at the top.

Third place Qualcomm registered $29 billion revenue, enduring a 16.6% decline compared to 2022. Conversely, fourth place Broadcom enjoyed a 7.2% increase in revenue to $25.6 billion. NVIDIA transformed from being twelfth to fifth due to a 56.4% surge in revenue to $24 billion, its maiden entry into the top five. As experts assert, this has been primarily due to the high demand for its brand’s computation accelerators from artificial intelligence developers.

SK Hynix degraded from the fourth to the sixth position as its revenue shrunk by 32.1% to $22.8 billion. AMD retained its seventh position, despite reducing its revenue by 5.6% to $22.3 billion. The top ten suppliers include beneficiaries of the high chip demand in the automotive segment. Notably, STMicroelectronics increased revenue by 7.7% to $17.06 billion, ascending from the eleventh to the eighth position. Apple is also found in the top ten list of chip suppliers, securing ninth place, but its revenue shrunk by 5.8% to $17 billion. Last year’s results see Texas Instruments descend from the eighth to the tenth position by compressing its revenue by 12.2% to $16.5 billion.

Within the first half of the year, the demand for components in three significant segments of the memory market (server, consumer, and smartphones) notably dwindled. This scenario led to a 37% deduction in memory segment revenue throughout the year. The DRAM memory market reduced its collective yearly revenue by 38.5% to $48.4 billion, while the NAND memory market saw a 37.5% decrement to $36.2 billion.

Excluding the memory market, the remaining market segments collectively reduced their revenue by 3%, as Gartner representatives clarify. This aspect of the market didn’t experience severe price oscillations experienced in the memory segment, with some directions observing chip demand growth. This includes the artificial intelligence domain, the automobile market, and the defense and aerospace sectors.