Intel Releases Detailed Year-end Revenue Report for Different Market Segments

Following last week’s release of general client system market statistics, Intel recently publicized its detailed yearly report, a 10-K form, showcasing detailed revenue dynamics in different market segments. The tech company indicates a 5% decline in notebook components supplies last year compared to 2022, while desktop supplies saw a sharper drop of 9%.

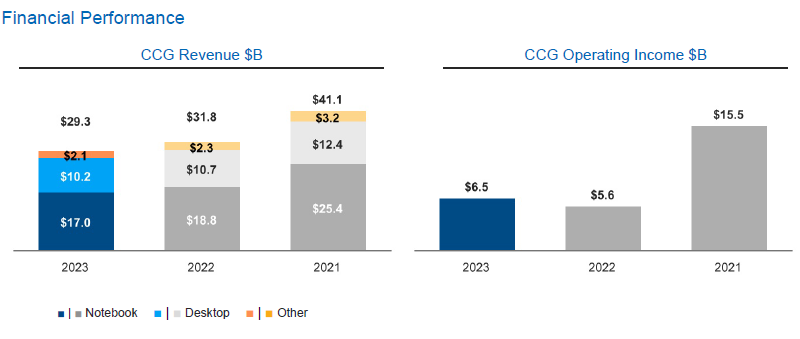

The aforementioned figures represent the delivery dynamics in physical terms, not financial ones. Intel’s notebook segment revenue fell by almost 10%, from $18.8 billion to $17 billion, with a particularly weak demand in the first half of the year. Intel reports a minor bounce-back in the second half, thanks to a surge in demand as accumulated inventory ran out. The average selling price of Intel’s notebook components declined by 5% in 2023 due to more demand from the educational sector, which predominantly gravitates towards budget processors with fewer cores or models of previous generations.

In the desktop market, Intel recorded a 4.7% drop in 2023 revenues to $10.2 billion, while physical deliveries fell by 9% compared to 2022. The second half of the year was more prosperous for the desktop PC market, but only due to the run-out of some stock inventories. Interestingly, against declining sales volumes, Intel remained tradition-bound and hiked the average selling price by a significant 5%, with higher-priced processor models finding more demand in commercial and gaming market segments.

When comparing 2023 with 2022, it’s clear that Intel’s client business, despite being slightly less profitable ($29.3 billion against $31.8 billion in revenue), managed to increase its operational profit from $5.6 billion to $6.5 billion. The client business also demonstrated more restrained product delivery volume reduction dynamics with a 5% and 9% decline in notebook and desktop components supplies, respectively. These figures present a significant improvement in comparison to 2022, which witnessed a 36% drop in notebook supplies and a 19% reduction in the desktop segment.