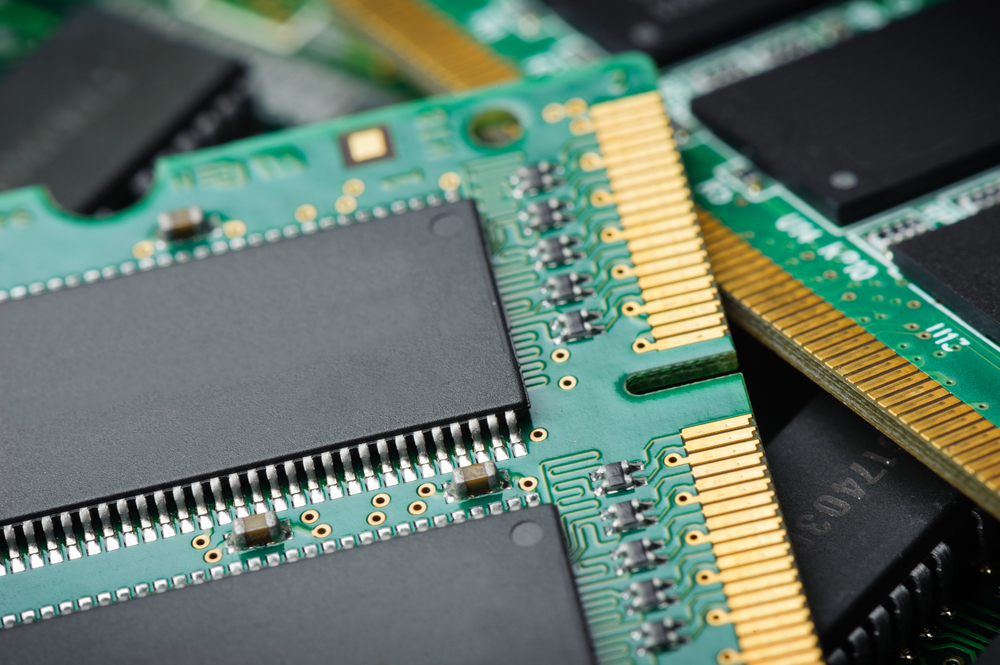

Following effective production cuts in the past year, the market has witnessed signs of recovery as computer memory prices have begun to rise. Market dynamics and demand correction point to new changes for the NAND memory components sector, analysts at TrendForce believe.

Price Surges in NAND memory

From the third quarter of 2023, NAND chip prices have been on the rise. Data suggests that the price dynamic for these chips in 2024 would depend on how fully utilized the manufactures’ capacities are. Wallace C. Kou, CEO of Silicon Motion, a memory controller manufacturer, believes that NAND memory prices have already stabilized for the second quarter, with a projected increase of about 20%. While some suppliers have returned to profitability in the first quarter, the majority expects to do so post the second quarter.

Pua Khein Seng, CEO of controller manufacturer Phison, warned that continuing hikes in SSD prices could seriously hamper demand. He proposed that NAND chip makers cease production cuts and meet demand instead of increasing prices due to low supply and high demand.

Production Changes in Manufacturers

The Samsung NAND chip factory located in Xian, China, in the latter half of 2023, had scaled back its productivity. Presently, it has largely recovered to reach around 70% of its production capability. The only Samsung memory chip facility located outside Korea, it accounts for 40% of Samsung’s overall NAND output with an impressive monthly capacity of 200,000 300-mm wafers. This year, Samsung plans to upgrade this factory for 236-layer NAND chip production and start comprehensive expansion, with relevant equipment being deployed.

Growth Projections

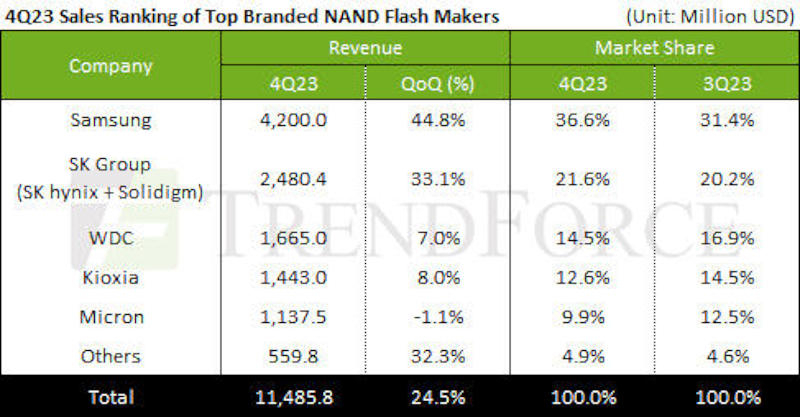

Analysts forecast that contract prices for NAND chips will increase by 20-25% in the first quarter of 2024. The general demand outlook for the second quarter remains conservative, especially since some clients had started restocking in the first quarter. Price hikes for the second quarter are projected to be around 10-15%. The NAND market harbors five major manufacturing firms, with lion shares going to Samsung (36.6% as of the fourth quarter of 2023) and SK hynix (21.6%). They are followed by Western Digital (14.5%), Kioxia (12.6%), and Micron (9.9%).

As the whole industry’s earnings in the fourth quarter of 2023 stood at $11.49 billion, which was a 24.5% increase from the previous quarter, the first quarter predicts an industry revenue growth of 20%, with NAND chip contract prices expected to average a 25% increase.