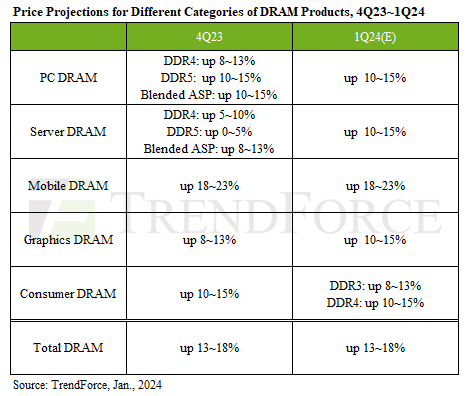

Experts at TrendForce have predicted a 13-18% increase in the prices of memory chips this year, with the most significant rise likely to occur in the mobile sector. The dynamics established in the latter part of last year are set to continue into this year, resulting in an even steeper increase of 18-23% for the first quarter.

Price Increase in Different Segments

In the PC sector, memory chip prices rose by 10-15% on average in the previous quarter. DDR5 chips (10-15%) increased in price quicker than DDR4 chips (8-13%). The demand for DDR4 memory will slowly decline as the industry inevitably transitions towards DDR5, the latter thus experiencing a faster price spike. Predicted contract prices for PC memory for the present quarter are also set to rise by around 10-15%, with DDR5 consistently outpacing DDR4.

Within the server segment, DDR4 chips experienced a 5-10% increase in the previous quarter, outpacing DDR5’s 0-5% rise. An average DRAM price rise of 8-13% was witnessed in the server segment. DDR5 has already claimed a 20-25% market share in this sector, with manufacturers prioritizing it when ramping up supply volumes. Contract prices for RAM in the server segment are expected to increase by 10-15% this quarter, according to TrendForce predictions.

In the mobile segment, where memory suppliers have managed to maintain the smallest inventory of finished products, price hikes are expected to outpace the rest of the market. Last quarter saw a 18–23% increase here, with a similar trend predicted for the current quarter. This sector of the memory market is controlled by a limited number of manufacturers, making it easier for them to manipulate market prices.

Graphics and Consumer Electronics Segments’ Trends

The demand for GDDR6 memory in the graphics segment is steadily rising that could result in contract price increases of 10-15% by the end of this quarter, up from the 8-13% increase seen last quarter.

In the consumer electronics segment, rising memory prices have prompted device manufacturers to stockpile DRAM chips, leading to a 10-15% increase in contract prices last quarter. In the current quarter, market prices are expected to rise by 8-13% for DDR3 and 10-15% for DDR4. Memory manufacturers anticipate a shift in demand towards DDR5 and HBM, which may limit DDR4 output. For this reason, DDR4 is likely to see faster price increases compared to DDR3, which Taiwanese manufacturers can supply in large volumes.