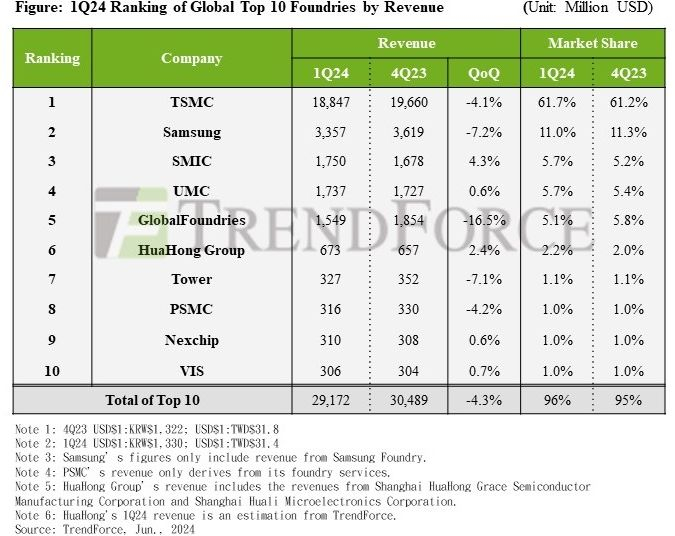

In the first quarter of this year, the revenue of the ten largest contract chip manufacturers decreased by 4.3% to $29.2 billion, generally reflecting seasonal trends. However, some market players managed to show positive dynamics, Chinese SMIC and HuaHong Group, for example, increased revenue by 4.3% and 2.4% respectively.

The first quarter for SMIC was characterized not only by an increase in market share from 5.2 to 5.7%, but also by securing third place in the top ten market participants. UMC now settles for fourth place, although it did increase its revenue by 0.6% sequentially. GlobalFoundries retreated to fifth due to heavy reliance on certain types of orders concentrated in the automotive components sector, industrial automation, and traditional servers unrelated to the AI segment. The company’s revenue fell by 16.5% to $1.55 billion.

The contract market leader continues to be TSMC with a 61.7% share, but its revenue sequentially decreased by 4.1% to $18.85 billion. Samsung Electronics, which ranks second, showed a revenue decrease of 7.2% to $3.36 billion. In the second quarter, TSMC’s revenue should sequentially grow, but by no more than 9% as the demand for AI systems servers will be supplemented by Apple’s seasonal activity in accumulating components for next-generation devices, which will launch in the fall.

Not only limited smartphone market activity, but also a trend towards using domestically produced chips by Chinese manufacturers let down Samsung in the last quarter. The revival of smartphone-oriented customers in the second quarter is yet to significantly influence Samsung’s revenue profile. Samsung still does not observe a large number of customers using 5-nm, 4-nm and 3-nm processes.

SMIC managed to increase revenue by 4.3% not only through orders for new models of Chinese smartphones but also through the desire of local customers to increase the share of localized chips in their product composition. Taiwanese UMC was effectively able to increase the volume of product shipments by 4.5% in the first quarter, but a decrease in the average selling price only allowed it to report a revenue increase of 0.6%.

Despite only taking sixth place in the ranking, the Chinese HuaHong Group was one of the few contract chip manufacturers who managed to increase revenue by 2.4% compared to the fourth quarter of last year. Its market share grew from 2.0 to 2.2%, and revenue reached $673 million. The company managed to increase both the volume of product shipments and the degree of plant utilization, but the growth in revenue dynamics was weakened by a decrease in the average selling price. NexChip and VIS (Vanguard) also sequentially increased revenue by 0.6% and 0.7% respectively. But in absolute terms, it barely exceeds $300 million; the companies can only claim ninth and tenth places respectively.

In the second quarter, according to TrendForce analysts’ forecasts, the total revenue of the ten largest contract chip manufacturers might only grow by a few percent sequentially as demands for AI system components will be accompanied by some revival in the smartphone market. However, the demand for chips manufactured by mature processes will grow slowly due to the overall adverse macroeconomic situation.