Analysts at TrendForce have presented a wrap up of last year’s performance for the ten largest contract chip manufacturers, remarking that it was not an easy period due to warehouse stockpiling, macroeconomic issues and slow recovery of demand in China. Altogether, the market leaders suffered a 13.6% decrease in revenue to $111.54 billion in 2021.

Q4 Revenue Increase for Top Ten Manufacturers

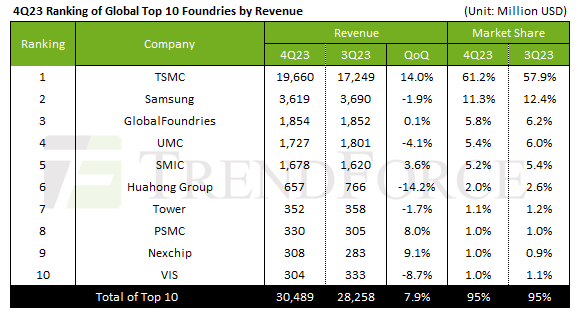

In Q4 alone, the top ten contract chipmakers managed to sequentially increase their revenue by 7.9% to $30.49 billion. Interestingly, this dynamic was largely driven by the rising demand for mid-range and low-end smartphone components as well as various peripherals chips. The release of new iPhone models in September last year somewhat revived the demand for smartphone components. The capability of TSMC to mass-produce 3nm products has boosted its market share to 61.2% in Q4. According to TrendForce’s analysts, the 2022 revenue for the top ten manufacturers will increase by 12% to $125.24 billion, with TSMC leading the growth due to its focus on advanced manufacturing processes in high demand for computational accelerators.

Company-specific Performance

TSMC, in Q4 of 2021, saw its revenue increase by 14% to $19.66 billion, with the revenue share from 7nm and below technology increasing from 59% to 67%, hence increasing reliance on advanced lithography. This figure is expected to overstep 70% soon. Meanwhile, Samsung Electronics’ contract arm sequentially saw its revenue decrease by 1.9% to $3.62 billion, and its market share reduced from 12.4% to 11.3%. The long-term chip supply contracts with automakers have benefited GlobalFoundries, ranked third, which increased its revenue sequentially by 0.1% to $1.85 billion, although its market share decreased from 6.2% to 5.8%. Taiwanese UMC maintained 5.4% of the market share seated at fourth place, but its Q4 revenue sequentially decreased by 4.1% to $1.73 billion due to temporary demand spikes failing to turn around the overall negative tendency.

Chinese SMIC grew its revenue by 3.6% compared to the third quarter to $1.68 billion, but its global market share slipped from 5.4% to 5.2%, although it managed to hold onto the fifth position. Interestingly, urgent orders for smartphone and laptop components fueled SMIC’s positive revenue dynamics, mostly originating from Chinese clients.

Changes in the Top Ten

Intel’s contract subdivision (IFS) was ousted from the top ten in the fourth quarter by PSMC and Nexchip, as IFS revenue suffered from process migration and higher inventory levels of products. In the latest quarter, Huahong Group from China, which ranked sixth, saw the highest decline in revenue, down 14.2% to $657 million. Israeli-based Tower Semiconductor, in the seventh position, experienced a 1.7% decrease in revenue and reduced its global market share from 1.2% to 1.1%. PSMC climbed to the eighth position with an 8.0% increase in revenue, but its market share remained at 1.0%. Nexchip returned to the ninth position, increasing its revenue by 9.1% and raising its market share from 0.9% to 1.0%. Vis (Vanguard), rounding out the list with the same market share of 1.0% and a revenue decrease of 8.7% to $304 million.