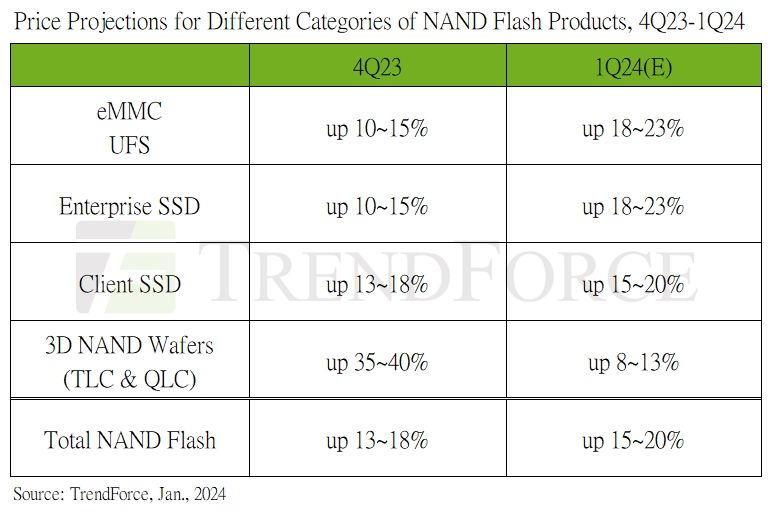

After a prolonged period of NAND memory surplus, manufacturers are striving to balance supply and demand. According to TrendForce, flash memory contract prices are predicted to rise 15–20% this quarter as buying volumes increase.

Uneven Production Tactics

Production policies in the first quarter will be varied, some manufacturers are reportedly ramping up production volumes. If demand doesn’t rise proportionally to offset increased supply, SSD memory prices may drop in the second half of the year.

Price Increases in Consumer SSDs

Last quarter saw an increase of 13–18% in the client SSD segment, with a further 15–20% expected this quarter due to high demand from PC manufacturers, particularly for laptops. Largely, this is due to industry-wide adoption of PCI Express 4.0 interface drives and large contract negotiations with clients.

Corporate Segment

While US cloud service provider SSD demand hasn’t increased, Chinese counterparts and independent server equipment manufacturers demonstrate a different behavior. Corporate clients are eager to purchase more SSDs before prices climb further. Following a price increase of 10–15% last quarter, the current quarter could potentially see a rise of 18–23%.

Smartphones and Chromebooks

SSD demand within Chromebook and smartphone segments is stabilizing. Manufacturers are actively increasing product prices, leading to a recognizable deficit in entry-level eMMC storage. Across the eMMC product range, contract prices are expected to rise this quarter by 18–23%, up from an increase of 10–15% in the last quarter.

UFS Segment

UFS inventories among smartphone manufacturers have hit critically low levels, particularly for UFS 4.0 generation solutions. The rise in silicon wafer prices in the late part of last year has spurred memory manufacturers’ efforts to recoup increased costs faster, impacting prices. For some UFS storage types, prices have increased by 30%, with an overall anticipated price increase of 18–23% for the quarter, driven mainly by the smartphone market.

NAND Memory Wafers

Throughout the current quarter, silicon wafers with NAND memory are expected to see average price increases of 8–13%. Uncertain demand dynamics prevent suppliers from fully benefiting from price advances. TrendForce analysts predict average contract prices for NAND chips this quarter will rise by 15–20%, up from 13–18% in the previous quarter.