Semiconductor and computer sales are experiencing a resurgence, with AMD positioned as a key beneficiary of the market’s rebound, as indicated by new data released by analysts at Mercury Research. Apex credits to AMD’s success are the thriving demand for Ryzen 7000 and 4th Generation EPYC processors. This information was shared by AMD.

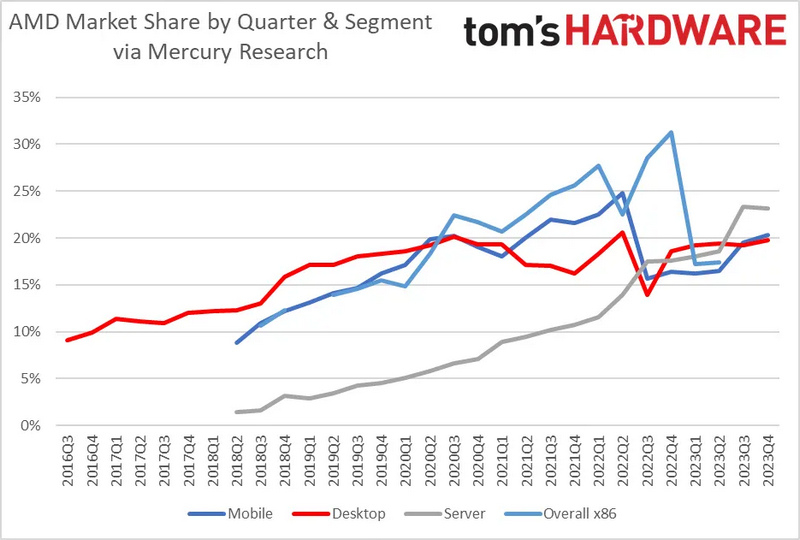

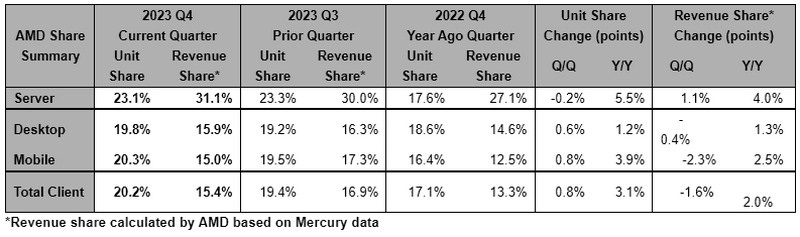

In the client CPUs segment, AMD increased its share by 3.1 percentage points (pp) in the Q4 of 2023, securing 20.1% of the market, an increase over the previous year. Revenue-wise, AMD witnessed a yearly growth of 2 pp, gaining 15.4% of total client CPU market revenue in the last quarter of that year.

There was a notable AMD share in desktop CPU consisting of 19.8%, the highest since Q2 2022, and close to mid-2020 figures. The Ryzen’s mobile segment also increased to 20.2%, a record not seen since midway through 2022.

Last year was challenging for the PC market. However, recent information from memory manufacturers suggests a positive outlook for 2024. As AI-equipped PCs are expected in the current year and the anticipated release of Windows 12, both consumers and businesses are showing increased interest in new systems and processors with built-in AI engines.

In the server business, AMD fares significantly better, thanks to its latest generation EPYC processors. AMD highlights that its server CPU market revenue share is at 31.1%, a record high for the company. Over the year, the company’s monetary share grew by 4.0 pp, generating record profits in this segment.

In the server processor segment, AMD’s growth in terms of quantity is even higher than revenue, adding 5.5 pp compared to Q4 2022. The company now actively partakes 23.1 % of the market. AMD did note a slight decrease in Q4 compared to Q3 due to “greater number of server processors sold by our competitors in applications unrelated to data centers and higher Atom shipments,” likely referring to Intel.

Do recall that Intel had a disappointing 2023 overall, but there was an upturn in Q4. Unlike AMD, its data center business reduced by 10% compared to the previous year, largely due to market contraction and inventory adjustments.