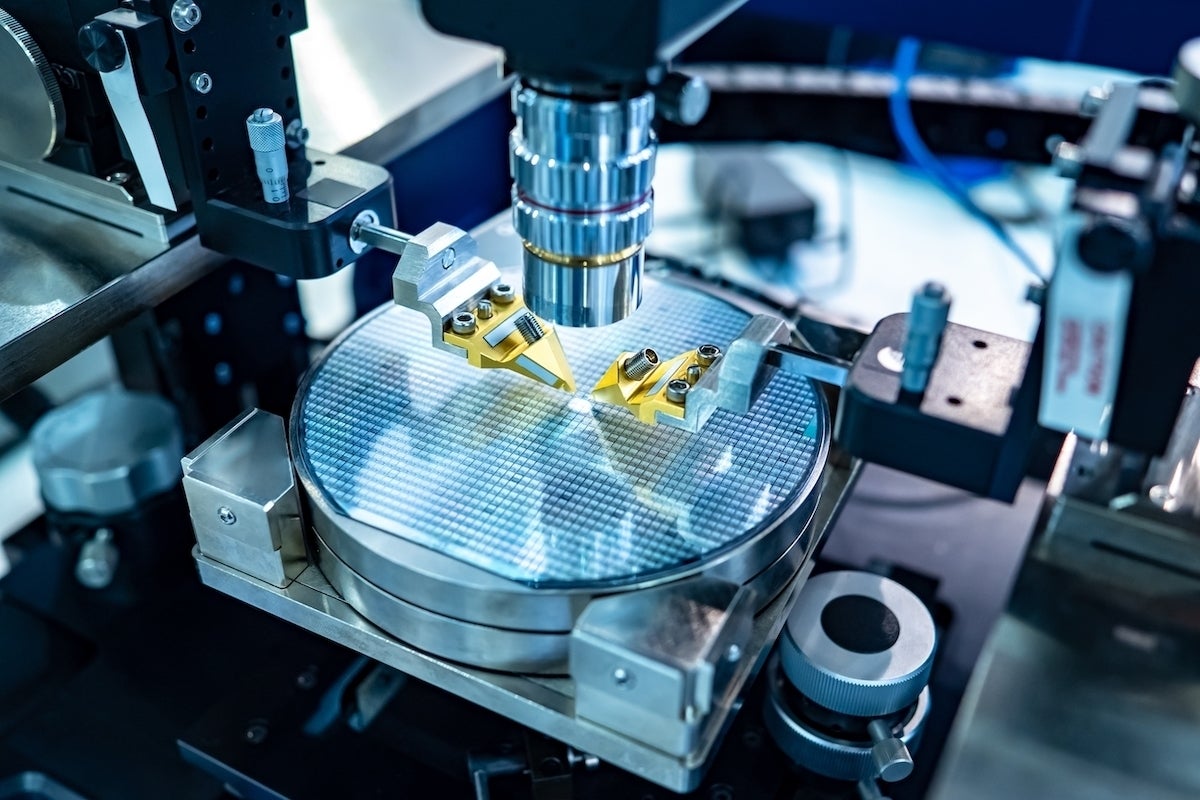

Applied Materials Foresees a Resurgence in Microchip Equipment Purchases

Considered an important industry barometer, US company Applied Materials’ quarterly report offers significant insight into the status of microchip production equipment purchases. Combined with favourable financial results, the company’s cautious optimism has seen its share price surge by 13% ahead of US trading.

Improved Revenue Forecasts Drive Share Price Increase

Strictly speaking, the revenue dynamics of Applied Materials for the first fiscal quarter of 2024, although slightly down from $6.739 billion to $6.707 billion, did exceed the investor-expected $6.32 billion. Together with a more optimistic projected revenue ranging from $6.1 to $6.9 billion for the current quarter, against the expected $5.92 billion, these factors have contributed to the rise in the share value of this American microchip production equipment supplier.

Demand for Applied Materials’ Products on the Rise

The company’s management signaled a broad market improvement in the demand for its products and a notable revival in memory chip production. With operations running close to maximal load, China has shown an impressive uptick in revenue, more than doubling its yearly total to $3 billion. With this, China’s portion of Applied Materials’ revenue has also grown from last year’s 17% to 45%.

The surge in the activities of Chinese clients is reportedly driven by the increased need for chips for Internet of Things devices, telecom equipment, automotive industry, as well as sensors and power electronics.

CEO sees Potential in Chinese Market

Applied Material’s CEO Gary Dickerson expressed positivity, remarking that “this market will surprise people” when discussing China. He added that “an electric vehicle contains thousands of chips, and there are many devices in edge computing, where chip content will grow”. This shows that even under sanctions, where Applied Materials is prohibited from supplying advanced technology chip production equipment to China, the local market still has the potential for product consumption.

The company has already been summoned to explain its relationship structures with the sanctioned Chinese contract semiconductor producer SMIC, one of the largest in China, to US investigative bodies.