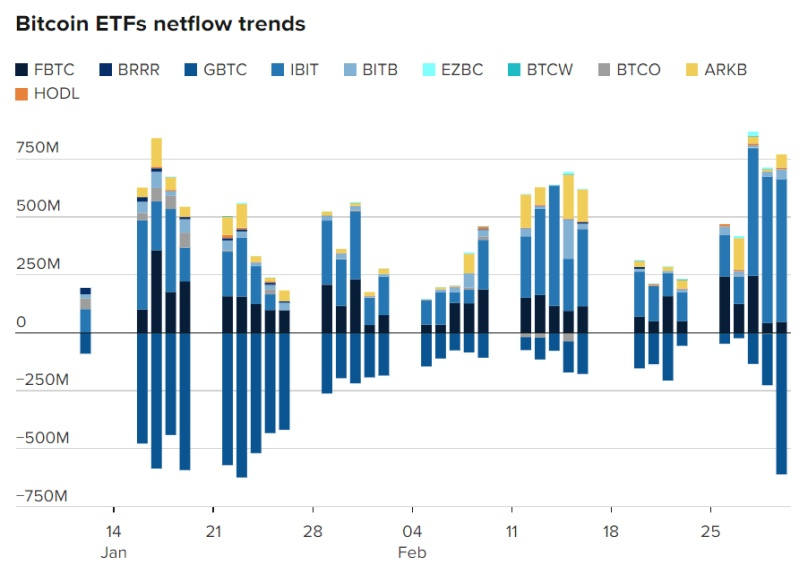

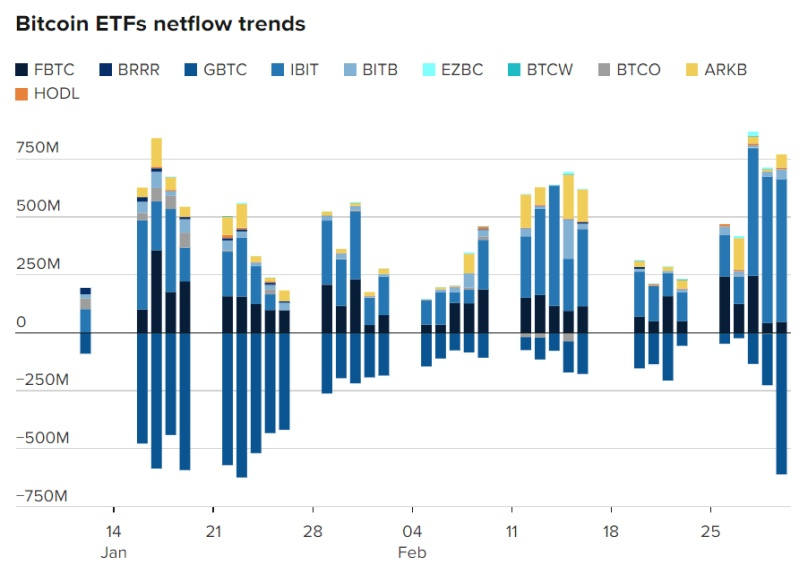

The continued wave of mass investment from new Bitcoin spot exchange-traded funds (ETFs) in the US is propelling the growth of Bitcoin. As of the ETF’s launch on January 11th, its price fluctuated around $45,000. After a temporary drop to $39,000, Bitcoin swiftly surpassed the psychologically significant mark of $50,000 by mid-February. After fluctuating around $51,000, Bitcoin began a steady climb, reaching a historical peak of $69,210 only to promptly slump to $66,000.

According to data from Coin Metrics, the previous Bitcoin record of $68,982 was set on November 10, 2021. Alex Thorn, Head of Research at Galaxy Digital, is confident about Bitcoin’s resurgence: “Bitcoin bouncing back to its all-time high shows that it will never vanish. In its 15-year history, Bitcoin has endured four 75% dips and bounced back sharply each time. People continue to demonstrate their need for a decentralized, programmable, and scarce digital currency.”

Analysts assert that this new record is a crucial psychological milestone demonstrating cryptocurrencies’ impressive resilience. “Bitcoin becomes more useful as its price rises,” added Thorn. “With a higher market capitalization and daily turnover, it can support larger distributions. Bitcoin’s volatility has been continually decreasing, allowing the allocation of larger positions.”

This may also indicate the beginning of a new wave of retail investors returning to the cryptocurrency market, hypothesized Needham analyst John Todaro: “Retail interest is generally driven by momentum, and record-high levels act as a key stimulative factor, triggering even more investment. Ironically, this could result in an increased inflow of capital into altcoins,” added Todaro.

The top cryptocurrency has appreciated almost 50% this year, partly due to the successful launch of US spot ETFs, and partly in anticipation of the upcoming halving which will halve the reward for each mined block to 3.125 bitcoins from the present 6.25. This week fuelled the bullish trend of the flagship cryptocurrency.

Experts opine that this new record is a triumph for the sector long plagued by reputational and regulatory risks which were at their peak in 2022 when investments in cryptocurrency were under duress, and the FTX cryptocurrency exchange collapsed.

Mike Novogratz, one of the early Bitcoin users, and CEO of Galaxy Digital, believes predicting the next step is challenging: “Bitcoin is at a stage determining its price. Probably for the first time since it became a financial asset because now the majority of the US financial market easily accesses it.” Galaxy collaborates with asset management company Invesco and is part of the ten spot ETF issuers in the US currently.

“The market is ready for a heavy correction, perhaps 10-20%,” asserts Ed Tolson, CEO and Founder of Kbit, a cryptocurrency hedge fund. “Any significant downward movement will lead to cascade liquidations in the cryptocurrency perpetual swap markets where retail trading has accumulated long positions with margin. This will ensure a very high level of funding. We anticipate the BTC performing well over the next few quarters, but with sharp corrections.”

Oppenheimer’s Owen Lau concurs with him: “The acceleration is so rapid that we approach the correction with caution. However, in the long term, catalysts still support positive price movement.”

Hunter Horsley, CEO of Bitwise, another spot ETF issuer, suggested that Bitcoin could soon achieve $250,000.