A Surge In Demand For Japanese HBM Memory Release Technology

South Korean firm, SK Hynix currently dominates the High-Bandwidth Memory (HBM) market, however, Samsung Electronics, its rival, plans to double its output this year. According to Japan’s Towa, there has been a significant increase in HBM specialized equipment orders this year, citing heightened demand from South Korean customers.

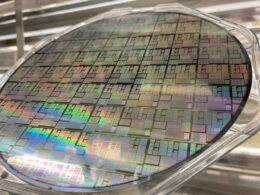

Leading Provider Of Chip Packaging Equipment

Towa, a Japanese company, is the largest provider of chip packaging equipment used in HBM manufacturing, controlling approximately 60% of the global market. Until now, the company has been supplying one or two specialist machines annually due to limited HBM production. However, according to Nikkei Asian Review, Towa has received orders for more than 20 specialized devices this year, predominantly from major Korean customers. Considering the activity of China’s CXMT, other clients are also ramping up their operations.

Exceptional Technology Attracts High Demand

Towa’s technology permits the filling of gaps between memory chips and the substrate with a specialized composition, thereby preventing air and moisture access during operation. The company has achieved a degree of accuracy that allows working with 5-micron gaps, a task which most competitors’ equipment are incapable of. The exceptional capability explains the increased demand for Towa’s equipment amongst South Korean HBM manufacturers. Market investors also show growing interest in the company, resulting in a 359% increase in Towa’s stock price since January last year.