Intel Revenue Surges by 10% in Q4 but Falls Short of Full-Year Expectations

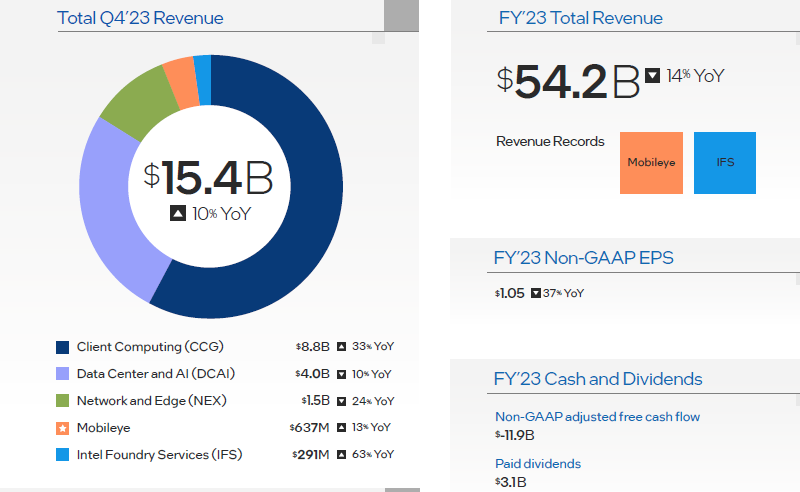

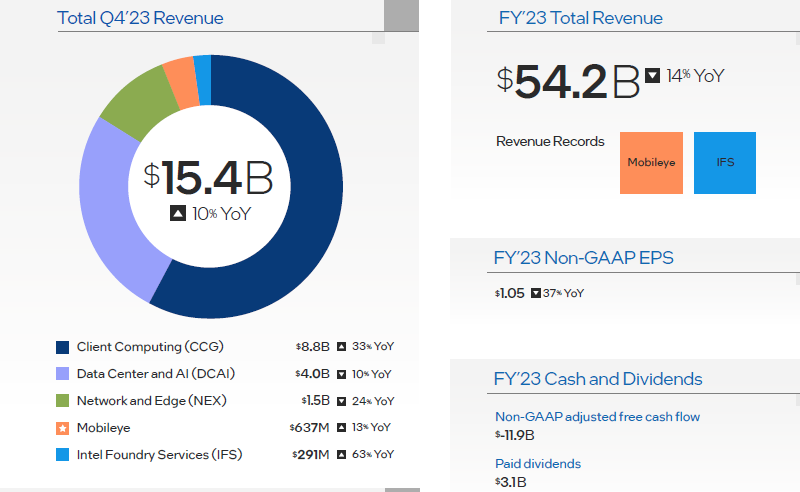

Intel, a multinational corporation specializing in manufacturing semiconductor chips, reported an increase of 10% in its revenue from the last quarter, breaking in $15.4 billion. However, the corporation’s yearly revenue saw a dip of 14%, tallying at $54.2 billion, according to the most recent statistics. Compounding the mixed financial results was a less-than-promising forecast for the current quarter, estimated between $12.2 and $13.2 billion, which fell short of analysts’ expectations, prompting a over 10% fall in stock price after hours.

Notably, Intel’s Q4 revenue exceeded investor expectations of $15.15 billion. However, analysts’ forecast for the current quarter was set on Intel earning $14.15 billion, thereby rendering Intel’s lower estimates a disappointment for them. CEO Patrick Gelsinger stated that the PC and server segments, the company’s primary revenue sources, are likely to feature at the lower edge of seasonal trends for the current quarter. However, most of the slump will be seen in the Mobileye and Programmable Solutions Group (PSG) unit’s revenue. Gelsinger assured that business remains stable and is expected to grow stronger.

While the final quarter witnessed a year-over-year growth, it ceased the consecutive decline seen in seven prior quarters. The company’s net income derived from the non-GAAP method grew by a whopping 263%, touching $2.3 billion. Previous year’s Q4 experienced losses of $700 million, according to GAAP standards, while this quarter made a profit of $2.7 billion. The profit margin rose from 39.2% to 45.7%, partly due to a 9% reduction in R&D expenses, totalling $5.6 billion. These measures also helped Intel achieve its 2023 goal of reducing yearly expenditures by $3 billion. Despite a disappointing Q4 operating loss, the operating profit margin reached 16.8%. Last year also saw Intel divest five of its business units to external investors.

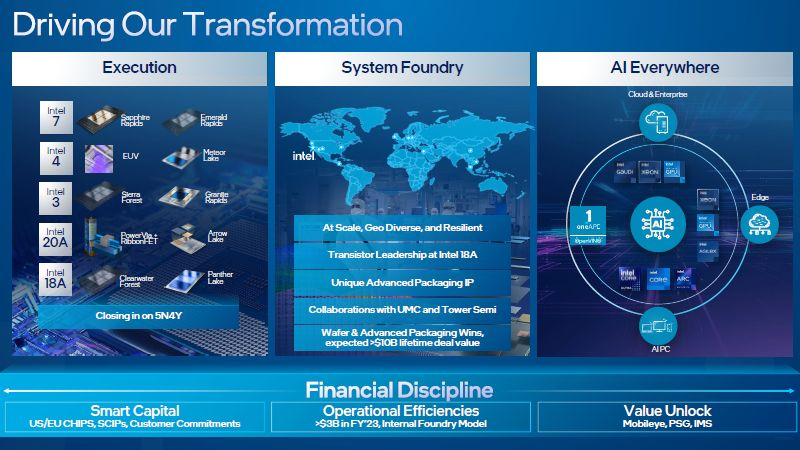

“In 2024, our focus will be on making progress and achieving product leadership, continuing the establishment of a global scale manufacturing network, and promoting the adoption of artificial intelligence,” said Intel’s chief during their quarterly earnings report. CFO David Zinsner added that the organization will continue implementing a business model of internal contract manufacturing in the current year, allowing greater transparency and control over expenses and providing a higher financial return to investors.

Overall, Intel experienced a 14% dip in annual revenue, totalling $54.2 billion in 2023. The profit margin fell from 42.6% to 40% following the GAAP method, with R&D and marketing expenses being reduced by 12%, coming down to $21.7 billion. Net income also suffered a significant 79% downfall, bringing it to $1.7 billion. Intel ended the year with $11.5 billion in free cash and paid out $3.1 billion in dividends.

The Client Computing Group (CCG), responsible for PC chips, saw a 33% boost in revenue during the last quarter, earning $8.8 billion. Still, the CCG’s yearly revenue fell by 8%, hitting $29.3 billion. Despite efforts to diversify, Intel remains 54% dependent on the PC market. The CCG’s operating profit went up by 451% in Q4, totalling $2.9 billion, as customers resumed purchases after an oversupply crisis.

Contrarily, the data center unit saw a 10% drop in revenue, finishing Q4 at $4.0 billion. According to Intel’s CFO, this resulted from the shifting of budgets from central processing units to computing accelerators. Server unit sales slumped by 20%, contributing $15.5 billion to Intel’s annual revenue. Operating profit for Q4 dipped by 38%, ending at $100 million.

Segmented Performances and Future Expectations

Intel’s performance varied across its different units. The Networking and Edge Group’s (NEX) revenue fell by 24% to $1.5 billion in Q4 and by 31% to $5.8 billion annually. Despite a 13% Q4 revenue dip, making $637 million, the Mobileye segment saw an 11% year-over-year increase, totalling $2.1 billion—a new record. The Intel Foundry Services (IFS) unit boosted its Q4 and yearly revenue by 63% and 103%, respectively—but fell short of the landmark $1 billion.

Looking forward, Intel plans on reclaiming its leadership position in lithography by 2025. To achieve this, Intel has begun installing the world’s first High-NA EUV lithographic scanner at its research center in Oregon. Intel experienced a moderate Q4 but expects its performance to improve in subsequent quarters. The firm also aims to reclaim its position in the PC and server components market and extend its reach in the AI accelerator market.

The expected surge in the PC market from 270 million to 300 million units this year, coupled with the introduction of processors equipped with local AI acceleration, is likely to stimulate demand for new computers.