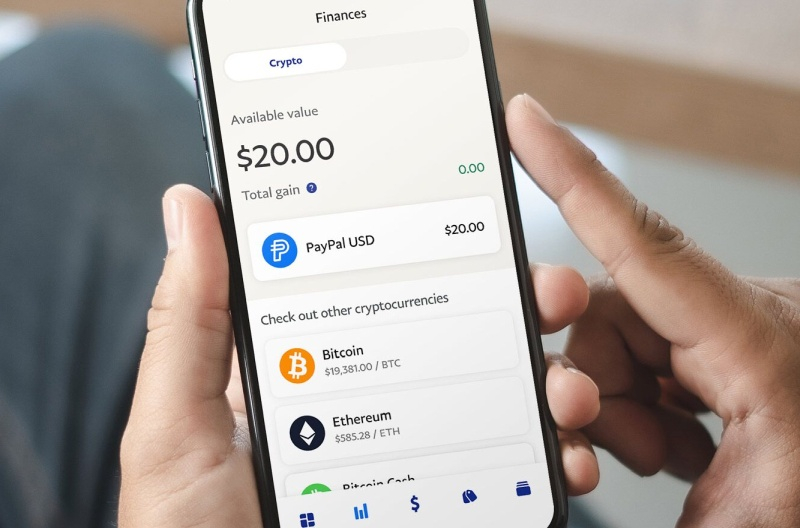

PayPal Advances in Crypto Space with PYUSD Token on Solana Blockchain

In a significant move, PayPal has joined the list of finance companies that have released their stablecoins, unveiling its token PayPal USD (PYUSD). Initially operational on the Ethereum blockchain since its August 2023 launch, PYUSD has now found a new home in the Solana blockchain, renowned for its popularity among meme coin issuers. PayPal’s choice for Solana was primarily influenced by its low transaction fees and swift processing times.

Solana’s Advantages: High Speed and Low Fees

Experts suggest that Solana currently boasts a processing speed of 1423 transactions per second, dwarfing Ethereum’s 12 to 15 transactions per second. According to PayPal’s Senior Vice President for Cryptocurrency, Jose Fernandez da Ponte, “if you are working in retail, you need to support at least 1000 transactions per second”. Despite Ethereum’s slower speed, da Ponte assures users that PayPal will maintain Ethereum for its customer convenience and largescale transaction processing capabilities.

As of now, trading volume on Solana has hit an over-two-year high mark, with meme coins such as Slerf, Boom of Meme, Snap, and Dogwifhat dominating decentralized exchanges. Despite earlier technical glitches leading to network slowdowns and outages, Solana has overcome the setbacks, asserting improved stability. “It seems like it’s a thing of the past”, says Sheraz Shere, General Manager Payments at Solana Foundation.

Market Performance and Future Plans for PYUSD

Industry analysts peg PYUSD’s current market capitalization close to $400 million, a minor fraction compared to Tether, the world’s leading stablecoin with a market capitalization exceeding $111 billion. PYUSD’s activity is primarily noticed within cryptocurrency exchanges and decentralized financial operations. However, PayPal aims at its broader adoption in retail payments and emerging markets in Latin America, Southeast Asia, and Africa. For instance, PayPal allowed its cross-border money transfer service Xoom clients to send funds overseas by converting dollars into PYUSD in April.

Regulatory Hurdles and Future Aspirations

PayPal’s stablecoin journey has not been without hiccups. The company halted work in this area in February 2023 due to detailed scrutiny from crypto regulatory authorities and received a subpoena from the US Securities and Exchange Commission’s law enforcement division in November. But da Ponte assures cooperation with the authorities, stating, “they requested some information. We’re working with them and providing it”.

Da Ponte expresses confidence in Solana and assures users of a switch to Ethereum in case of a breakdown. He signaled PayPal’s intent to add PYUSD to more blockchains in the future: “Our intentions [concerning] the stablecoin were to make it multichain from the start, so we will continue to evaluate others [blockchains].”

Shere points to PayPal’s venture into stablecoins as an indication of traditional payment companies increasingly embracing digital assets. Citing Stripe Inc’s decision in April to allow stablecoin online payments, he asserts “It truly feels like the fintech industry is breaking through [into the digital markets], and I think stablecoins are a product that many people in the blockchain were awaiting.”