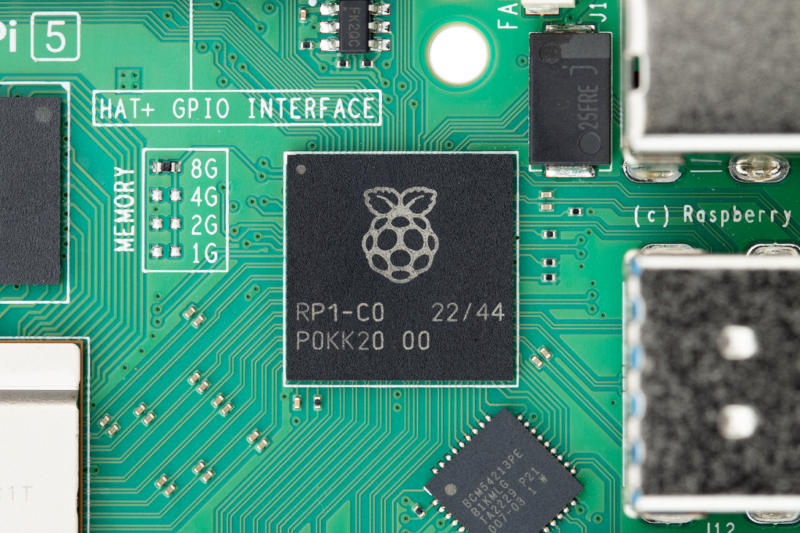

In a victory for the UK capital – a laggard in Europe’s revival of listings – Raspberry Pi, the British single-board computer manufacturer, has confirmed its intention to conduct an initial public offering (IPO) in London.

Participants and Details of the Listing

The listing will involve new shares aimed at raising $40 million, accompanied by the sale of existing ones by interested parties. The non-profit-controlled company, Raspberry Pi, intends to list on the main platform of the London Stock Exchange (LSE) by June, according to the company’s announcement.

This relatively modest IPO has been welcomed as a much-needed boost for the flagging UK market, which has seen its share drop to 2% of the $12.3 billion generated in Europe this year— marking its lowest standing in decades.

Pre-IPO Valuation and Partner Investors

Raspberry Pi had sought a valuation of $500 million ($637 million) on its exchange debut. Arm’s investment division has agreed to acquire $35 million of shares during the IPO, with Lansdowne Partners UK ready to purchase assets worth up to $20 million — both of which are shareholders in the company. Apart from Arm, Sony has also invested in Raspberry Pi. Arm itself, however, chose to go public not in London but in New York.

Financial Performance and Use of IPO Proceeds

Raspberry Pi’s revenue was $265.8 million last year, with adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) amounting to $43.5 million. Jefferies International Limited and Peel Hunt LLP will act as the global coordinators for the IPO. Funds from the sale of the new shares will be used to cover capital expenditures, bolster the supply chain’s resilience, among other purposes.