Based on the latest report from Jon Peddie Research (JPR), global consumer PC processor shipments hit 66 million units in Q4 2024, outperforming both the previous quarter and sales for the same period last year. PC manufacturers have depleted previously accumulated CPU stocks and resumed processor purchases from suppliers, signaling a trend towards sustained growth in the processor market.

CPU manufacturers like AMD and Intel delivered 66 million consumer PC chips in the fourth quarter of 2023, a 7% surge from the previous quarter’s 62 million units, and a 22% rise compared to the same period the year before with 54 million units. Notebook chips accounted for 70% of CPUs sold in Q4 2023, up from 63% in Q4 2022, reaffirming notebooks’ sustained precedence in sales over desktop PCs.

Jon Peddie, JPR’s President, sees the Q4 client processor shipment increase amidst overall gloomy news as a positive. He cites rising geopolitical tensions in the Middle East, trade wars with China, and extensive layoffs despite falling inflation and GDP growth as a cascade of bad news.

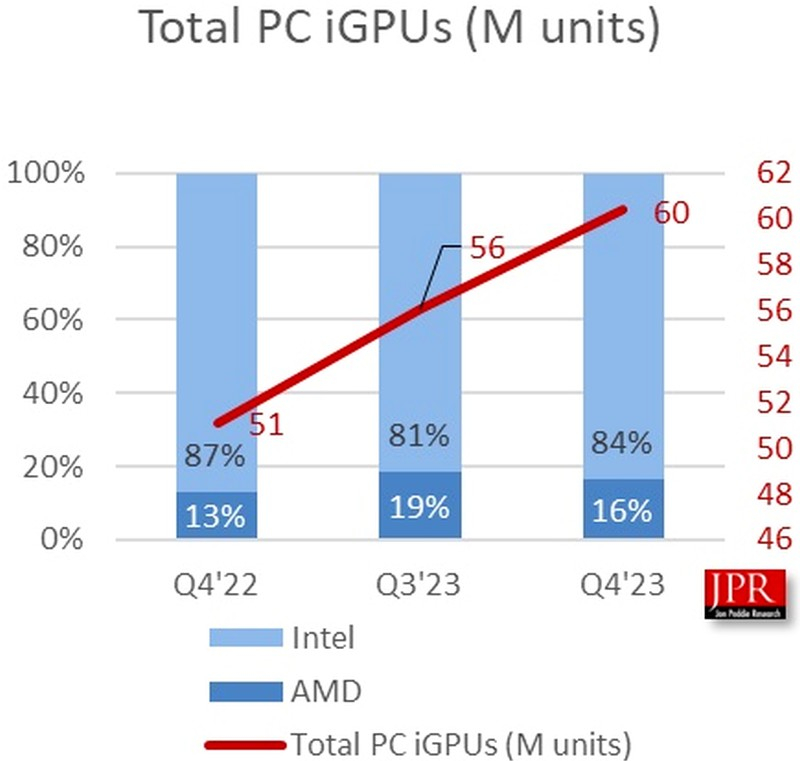

As the majority of client processors come with an integrated graphics processor, the rise in integrated graphics processors (iGPU) sales is unsurprising. These shipments hit 60 million units, marking a 7% increase from the previous quarter and an 18% rise compared to the same period last year.

JPR predicts the domination of iGPUs in the PC market to increase to 98% penetration in the next five years. iGPUs will likely feature in almost every PC. However, that does not suggest a decline in the demand for discrete graphics cards.

The scenario is significantly worse in the server processor segment, with a modest 2.8% growth compared to the previous quarter and a steep 26% drop compared to the same period a year ago. Nevertheless, the overall positive processor market dynamic indicates the sector’s ability to adapt and thrive amidst economic and geopolitical uncertainties.