SMIC Ascends to Third Place in Global Foundry Industry

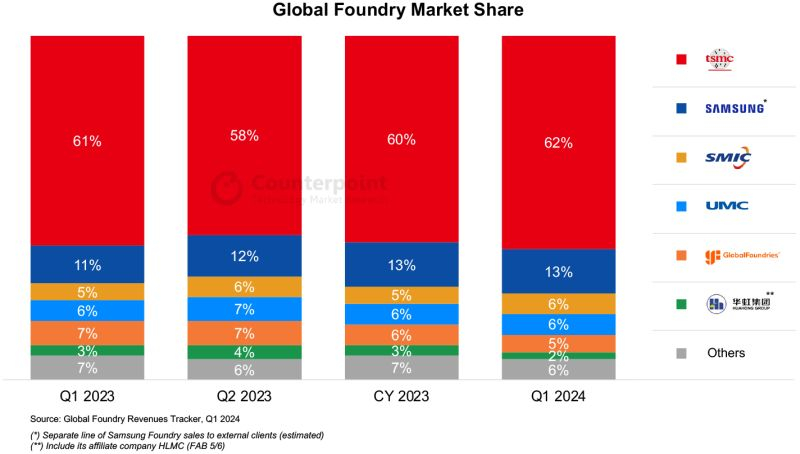

China’s Semiconductor Manufacturing International Corporation (SMIC) has made significant progress in claiming a larger market share in the contract chip manufacturing industry, according to various sources. Experts from Counterpoint Research confirm that SMIC has recently ascended to third place with a 6% market share for the first time in the previous quarter.

As per Counterpoint Research’s findings, SSMIC’s success is attributed to a revived demand for various kinds of semiconductor components in China’s domestic market. Despite the initial 4-6% growth forecast for the year, SMIC is expected to see its revenue for the second quarter increase by 14-16%. This unprecedented leap positions SMIC in a favourable spot against UMC, barely nudging them from the third place.

Overall Industry Trends

According to a Counterpoint Research report, the contract services industry saw a 5% decrease in total revenue for Q1. Demand recovery on final markets for chip manufacturers has been slower than desired. Although chip packaging capacities using CoWoS technology will double by the end of this year due to a boom in the AI systems industry, supply will still lag behind market demands.

Year-on-Year Growth

Despite the quarterly decrease, the chip contract manufacturers’ revenue grew by 12% in Q1 YoY. Specifically, TSMC has seen its revenue prediction for logical components drop from “more than 10%” to simply 10% due to weak demand outside of the AI segment. Despite this setback, the company’s AI-generated revenue will increase more than two folds. As of Q1, TSMC commands 62% of the global contract services market share in terms of revenue.

Competitor’s Landscape

Samsung Electronics, another third-party chip manufacturer, has maintained its 13% global market share in Q1. However, its revenue has shrunk due to seasonal trends in the smartphone market. Counterpoint Research analysts expect Samsung’s revenue to witness a double-digit percent increase in Q2.

UMC and GlobalFoundries, which hold 6% and 5% of the market respectively, are anticipating a return to growth in the smartphone segment. While GlobalFoundries expects to see an increase in revenue in the automotive segment by Q2, UMC may find it challenging to mirror this effect. As the inventory situation normalizes across various market segments, customers will look to replenish stocks this year, creating more favourable conditions for contract chip manufacturers.