Two South Korean semiconductor manufacturers who control 60% of the global market find themselves in a dilemma over escalating tensions between the US and China. While they have been able to secure some concessions from the US enabling them to expand their business in China, it’s a precarious situation as China is South Korea’s largest trading partner and semiconductors form a crucial part of its economy.

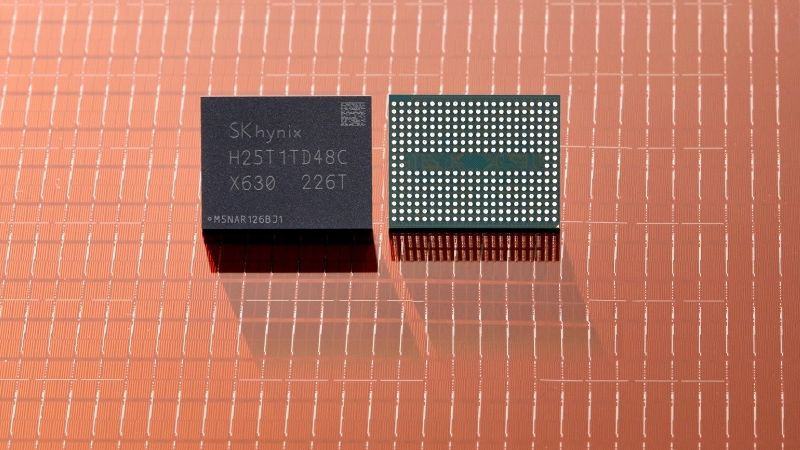

Through significant diplomatic efforts, South Korean companies Samsung Electronics and SK hynix have been granted permission to ship memory manufacturing equipment to China bypassing the standard US export restrictions, according to the South China Morning Post. However, it remains unclear how long these exemptions will stay in place. The current setup also benefits the US economy as South Korea produces nearly 60% of the world’s DRAM and NAND memory chips.

Following Intel’s decision to no longer independently produce flash memory, their factory in Dalian, China was sold to SK hynix in late 2021 for $9 billion. Despite the US starting to restrict memory manufacturers’ investments in China’s economy the next year, SK hynix has stated they have no intentions to let go of their Chinese factory.

Amidst the US restrictions, the Dalian SK hynix plant could potentially be a liability for the company. The development of the site has been slow, with a new factory being built alongside the existing one, yet no rush to equip it with necessary machinery. The payment for this purchase is due by next year, and Intel’s logo still graces the factory’s façade. Experts believe SK hynix are treading carefully during the US presidential election year, as a political shift could hinder their business in China.

Rumors have circulated about SK hynix’s intentions to sell the Dalian factory, but the company’s executives denied this last year, stating: “We are not considering selling our factories in Dalian at all. SK hynix will continue its operations in China while respecting the laws of the jurisdictions in which we do business and contribute to the semiconductor industry’s overall development”. It is worth noting that Korean memory manufacturers heavily rely on equipment from US suppliers, making it crucial to keep in good standing with their American partners.

The International Monetary Fund warned that South Korea could be one of the hardest-hit Asian Pacific nations in the so-called trade war between the US and China, which involves the constant expansion of mutual capital and product restrictions between these two countries. Companies like Samsung Electronics and SK hynix have had to increase lobbying expenses within South Korea and the US government structures. These efforts seem to be bearing fruit as they have been granted concessions for working in China, but post-US presidential election implications remain uncertain.

China remains the biggest market in terms of trade volume for South Korea, with the US at a close second and also providing security to the Asian nation. This gives local politicians the challenging task of balancing interest. SK hynix, the world’s second-largest memory manufacturer, earns 27% of its revenue from the Chinese market.

However, experts have noted that Korean companies have been ramping up product exports to the US. For the first time in over two decades, the US market has overshadowed China in turnover early this year. If the confrontation between the US and China intensifies, Korean manufacturers may be forced to make a difficult decision.