Nvidia Surpasses Quarterly Revenue Expectations, Bolstering Stock Market Confidence

Anticipation of Nvidia’s quarterly report saw market participants raising their revenue forecasts for the tech company to an average of $24.65 billion. However, the actual revenue of $26.04 billion outpaced market expectations. Predictions for the current quarter have also climbed beyond analysts’ figures. Furthermore, the planned stock split has piqued investor interest, making Nvidia’s share price surpass the $1000 mark for the first time ever.

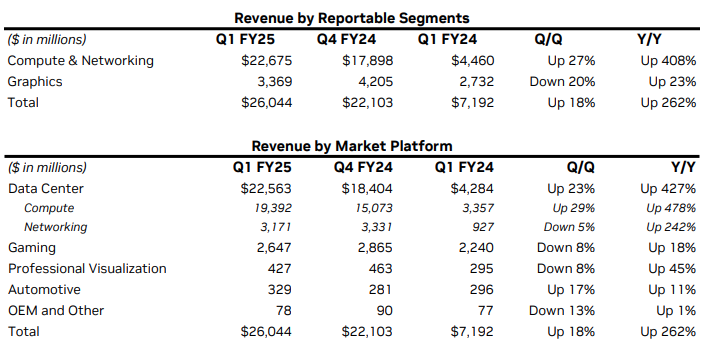

In concrete terms, Nvidia’s share price rose by 6% to $1007 at the close of the primary trading session, reaching a historical peak. The earnings per share stood at $6.12, compared to the predicted $5.59. The company projects a revenue of $28 billion for this quarter, which surpasses the analysts’ average estimate of $26.61 billion. Nvidia’s net profit for the previous quarter soared to $14.88 billion, over seven times the previous year’s $2.04 billion. Profit margin also increased year-on-year, from 64.6% to 78.4%. The company’s total revenue increased by 262% year-on-year to $26.04 billion, and sequentially by 18%.

Server Segment Boosts Nvidia’s Performance

It’s clear that the server segment was the primary driver behind Nvidia’s financial performance, with revenue in this sector rising by 427% year-on-year to $22.56 billion and consecutively by 23%. The company has separate revenue statistics for server computational solutions, where revenue grew by 478% to $19.39 billion. Meanwhile, network solutions posted a solid 242% increase in revenue to $3.17 billion. As stated by Nvidia’s CFO, Colette Kress, approximately 45% of Nvidia’s server revenue comes from large cloud providers.

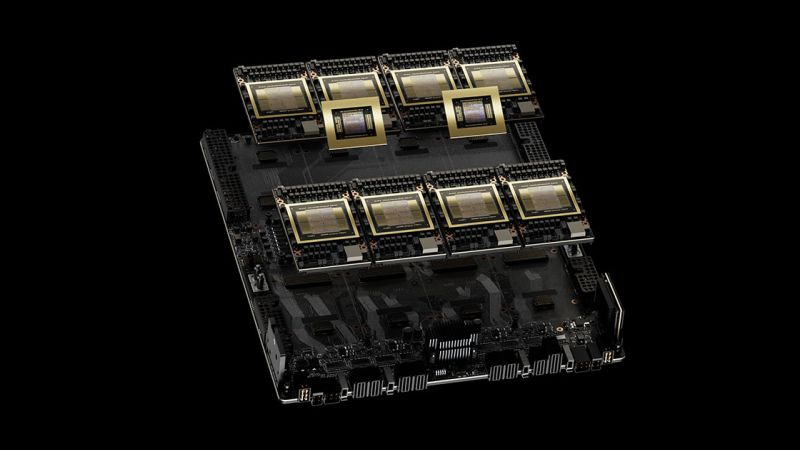

In the words of Jen-Hsun Huang, Nvidia’s CEO and founder, the upcoming Generation Blackwell accelerators, set to hit the market in the fourth quarter of this year, will spur more revenue growth: “We will see significant Blackwell revenue this year.” He explains that these new-generation chips are now in mass production, but demand surpasses supply, leading to a components shortage that will be with us until next year.

Gaming Performance Lags Behind Server Segment

Compared to the server segment, Nvidia’s gaming achievements seem rather modest. Revenue for this part of the market rose by 18% year-on-year to $2.65 billion, making up only about 10% of the company’s total revenue in the previous quarter. Looking at the overall structure of Nvidia’s revenue, computing and network solutions made a 408% increase to $22.68 billion, whereas graphics only added 23%, amounting to $3.37 billion. Professional visualization solutions also improved, reporting a 45% year-on-year growth in revenue to $427 million. Nevertheless, the gaming segment has been able to distribute more than 100 million units of the GeForce RTX family.

The Automobile Segment: A Modest Revenue Source

The automobile segment remains a rather modest source of revenue for Nvidia, with a year-on-year increase of 11%,

amounting to $329 million – though it grew sequentially by 17%. Nonetheless, for vertically integrated industries’ data centers, the automotive sector will be the biggest revenue earner this year. As an example, Nvidia has already supplied about 35,000 H100 accelerators to Tesla, aiding the advancement of the FSD complex. Meanwhile, in the OEM sector, which also counts laptop manufacturer deliveries, Nvidia’s revenue grew by just 1% year-on-year to $78 million but decreased sequentially by 13%.

In the previous quarter, Nvidia also allocated $7.7 billion for buying back its shares and paid $98 billion in dividends. Following the stock split anticipated in June, the company plans to increase dividends two-and-a-half-fold, enabling shareholders to receive 1 cent per company security. This move has further stimulated demand for the company’s shares. The house believes that the successful publishing of the quarterly report will add at least $100 billion to Nvidia’s capitalization and facilitate a 100% rise in share price since the start of 2022.

Nvidia has begun shipments of H200 accelerators this quarter, helping to maintain steady demand for the Hopper family solutions even with the forthcoming transition to Blackwell. The availability of H100 accelerators is improving, but H200 and eventually Blackwell products will continue to be in short supply, not just for the rest of this year but for a significant part of the next, as clarified by Nvidia representatives. They also started mass-quantity deliveries of Grace Hopper accelerators and have observed their usage in 80% of the supercomputers currently being assembled.

How US Sanctions Impact Nvidia’s Ability to Supply to China

The effect of American sanctions on Nvidia’s ability to supply necessary accelerators to customers in China was also discussed during the reporting event. The company leaders simply explained that revenue in this area had significantly decreased compared to previous values. The situation in the Chinese market has become noticeably more competitive for Nvidia, as the performance of its available accelerators here is hampered by sanctions. In any case, Nvidia continues to supply Chinese clients with those accelerator models that can be shipped to China under US sanctioning conditions. Nvidia also noted demand for its computation accelerators from governments worldwide. This segment could provide the company with up to $8–9 billion in revenue this year, though it was negligible in previous years.