Political Factors Influence AI Accelerator Trade in China

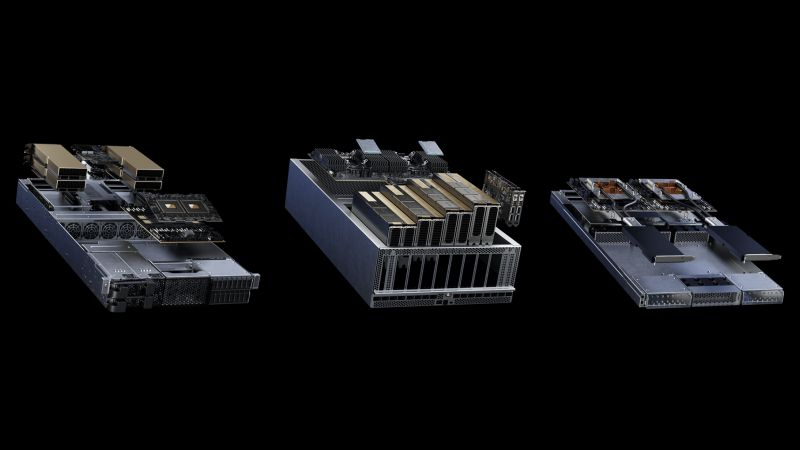

Nvidia, a leader in the global acceleration market, is facing challenges in selling its latest accelerators in China due to political influences. Restrictions from the US prevent the company from exporting its top-tier products, while domestic authorities advise Chinese firms to buy local accelerators. Consequently, Nvidia is forced to offer significant discounts on its H20 accelerators, the most advanced model available in China.

Nvidia’s Market Struggles

Reuters reports that US sanctions that began in October 2021 prevented Nvidia from releasing its specialized H20 accelerator in China until last month. The product was only made available less than a month ago, with internet giant Alibaba placing an order of over 30,000 units. However, Nvidia has had to offer discounts right from the start, as it faces stiff competition with Huawei’s HiSilicon Ascend 910B accelerators. In some tasks, the performance of the two devices is on par, but Nvidia’s accelerators are already being sold at a 10-16% lower price point than Huawei’s.

Facing Competitive Pricing and Lower Revenues

Analysts at SemiAnalysis predict that Nvidia will sell about 1 million H20 accelerators in China in the second half of this year, but the company will have to maintain competitive pricing. Nvidia’s management admitted during their recent quarterly conference that they were struggling to work in the Chinese market. Revenues have significantly declined, and last fiscal year China constituted up to 17% of Nvidia’s total earnings. For Finance Director, Colette Kress, the Chinese market is becoming increasingly competitive. The company is prevented from selling its leading accelerators and the H20 accelerators are already comparable in performance to Chinese offerings.

Profit Margins Declining

According to SemiAnalysis, the manufacturing cost of an H20 is higher than the H100, but Nvidia is obliged to sell the former in China for just half the cost of the latter. This does not necessarily mean Nvidia is operating at a loss, given their traditionally high mark-ups on acceleration units. However, the company’s profit margins in China are substantially reduced compared to previous periods.