The Semiconductor Industry Association (SIA) reported an April statistics that showed a 1.1% increase in global semiconductor sales compared to March, reaching $46.4 billion. This rise marks a reversal in a trend of consecutive decline seen earlier this year. Year-over-year, sales increased by 15.8%, with the Americas showing the most significant growth at 32.4%.

In dollar terms, April’s semiconductor revenues in both Americas rose 32.4% to $12.64 billion compared to the same period last year. China, which saw a modest sequential increase of 0.2%, saw a year-over-year growth of 23.4%, resulting in revenues of $14.17 billion. The Asia-Pacific region, excluding Japan, witnessed an 11.1% rise in chip sales, coming to $11.79 billion. Conversely, Japan and Europe both reported declining revenues – Japanese semiconductor sales declined by 7.8% to $3.59 billion, while European revenue fell 7% to $4.25 billion.

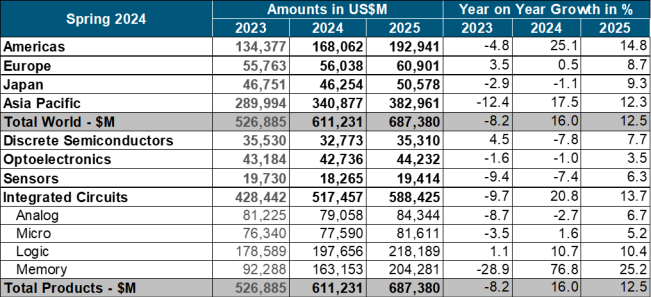

The World Semiconductor Trade Statistics (WSTS) forecast suggested that semiconductor sales will grow by 16% to a record-breaking $611 billion in the current year and are projected to rise by a further 12.5% to $687.4 billion in the upcoming year. As with the April revenue increase, the Americas are expected to lead growth. According to the WSTS forecast, logic components (10.7%) and memory (76.8%) will be the fastest-growing market segments in the current year. Other semiconductor components are predicted to grow at a rate in the single digits. The Asia-Pacific region, excluding Japan, is projected to trail the Americas as the second fastest-growing region, with a growth rate of 17.5%. For the next year, logic components and memory are forecasted to remain the revenue growth leaders in the semiconductor sector, contributing over $200 billion each, with memory revenue expected to grow by over 25%.