NVIDIA’s Quarterly Revenue Climbs 265% to Record $22.1 Billion

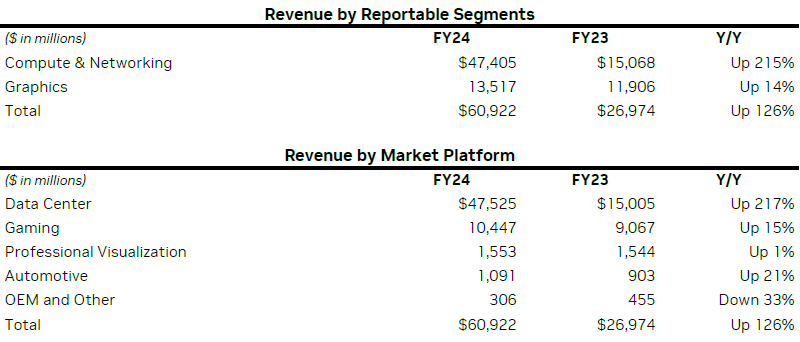

NVIDIA’s quarterly revenue surged 265% to a record $22.1 billion surpassing market expectations. The closing stock price saw a jump of 9.07% following the news. For the year, the company’s revenue grew an impressive 126% to a record $60.9 billion, with three-quarters of it being attributed to the server segment.

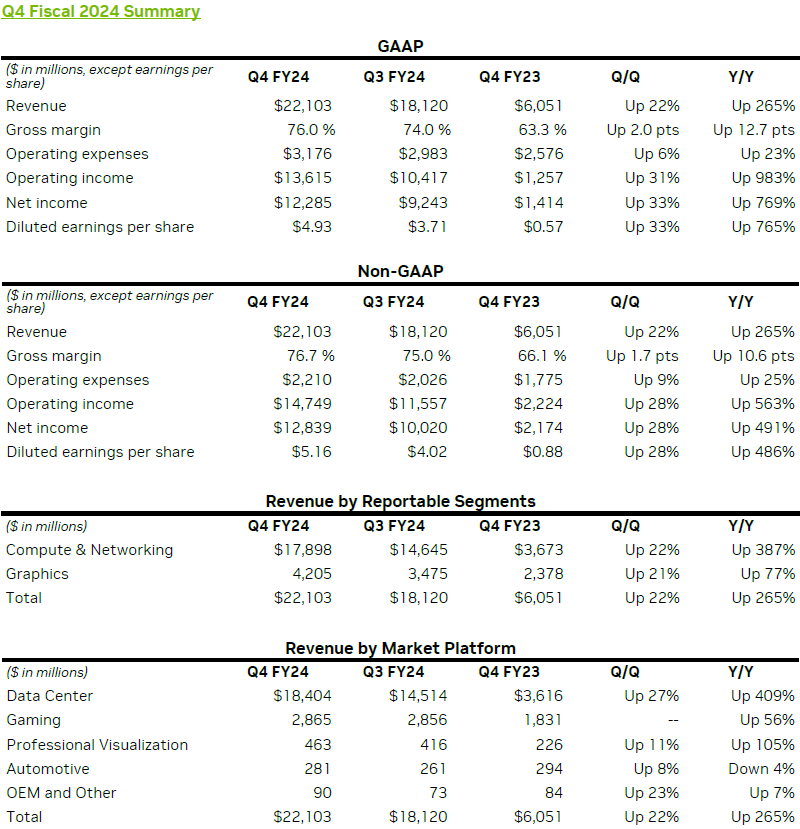

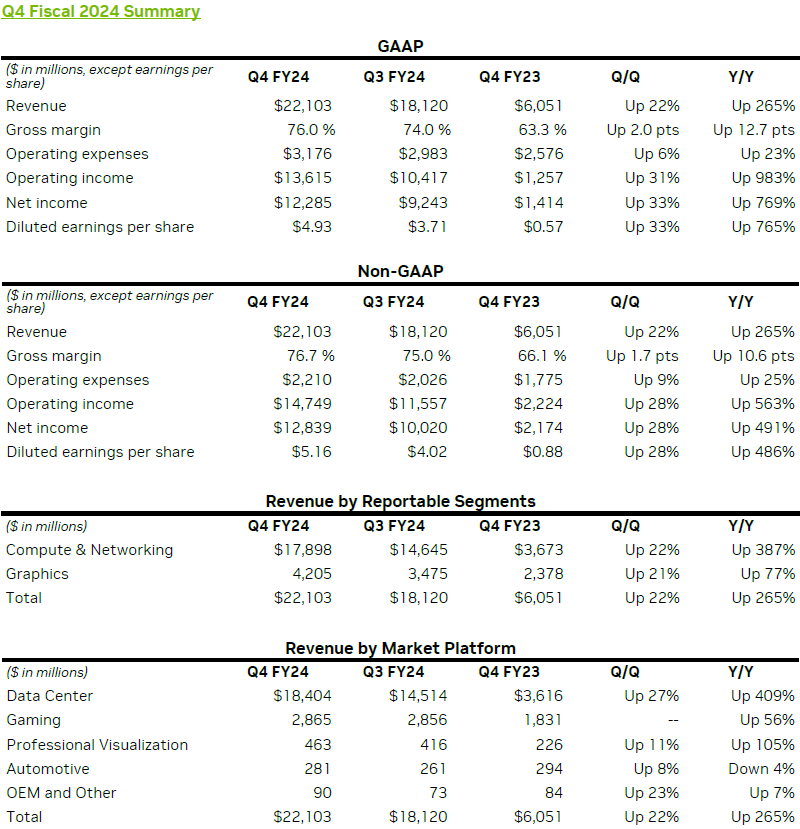

The press release highlights NVIDIA’s server revenue in the fourth fiscal quarter of 2024, which ended in late January for the company, also hit a record $18.4 billion, up 27% sequentially and a remarkable 409% year-on-year. In addition, NVIDIA’s earnings per share for the quarter surged 586% to $4.93 (GAAP method) and 486% to $5.16 (Non-GAAP method).

In his opening speech at the reporting event, NVIDIA’s founder and CEO Jensen Huang stated, “The acceleration of computations and generative artificial intelligence have arrived at a tipping point. Demand is growing globally, demonstrated by companies, industries, and countries”. He also pointed out that the NVIDIA RTX platform, introduced six years ago, has reached not just 100 million gamers and content creators, but has also become a popular platform for generative artificial intelligence. The CEO promised significant new product cycles this year.

Overall, the company’s quarterly revenue rose 22% sequentially to $22.1 billion, while year-on-year growth was calculated at 265%. The annual profit margin increased from 63.3% to 76% (GAAP methodology), and operational expenses grew 23% to $3.2 billion. Last quarter’s operational profits skyrocketed over 10 times to $13.6 billion, while net profit rose 769% to $12.3 billion (GAAP methodology).

The annual results were slightly more reserved in terms of performance dynamics. Revenue increased 126% to $60.9 billion, the profit margin rose from 56.9% to 72.7%, and operational expenses grew by 2% to $11.3 billion. Operating profit grew 681% to $33 billion (GAAP method), net profit increased 581% to $29.8 billion, and earnings per share rose 586% to $11.93.

NVIDIA expects to rake in about $24 billion in the current quarter and maintain a profit margin in the range of 76.3% to 77%, depending on the calculation method. The company’s founder assured attendees at the reporting event that the fundamental conditions are expected to drive growth in NVIDIA’s financial performance indicators not only in the current fiscal year but also in subsequent ones. He cited a shift in demand from CPUs to GPU-based accelerators as a key underlying trend. Major cloud providers accounted for over half of NVIDIA’s server segment revenue in the fourth quarter.

Several factors, including U.S sanctions, resulted in a significant reduction in NVIDIA’s server revenue in China, only accounting for 14% of the company’s server revenue for the year compared to the previous 19%. Nonetheless, in absolute terms, NVIDIA’s annual revenue in China grew from $5.8 billion to $10.3 billion, constituting around a fifth of the company’s total revenue.

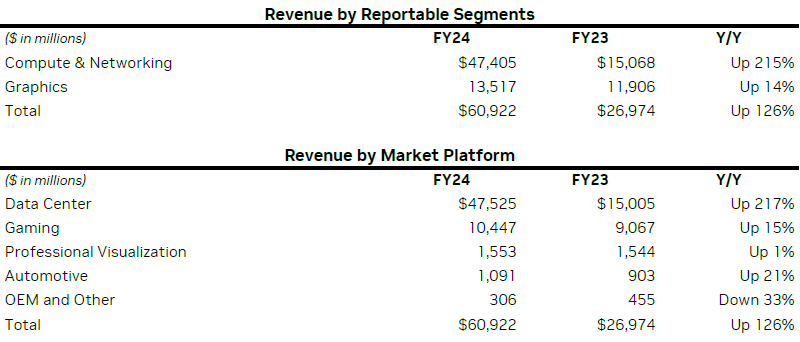

The server segment propelled NVIDIA’s revenue growth both in the past quarter and throughout the year. Quarterly server revenue soared 409% year-on-year to $18.4 billion, while the annual figure increased by 217% to $47.5 billion. Combined with network solutions, NVIDIA sold a total of $47.4 billion worth of computational components for the year. Graphics solutions only accounted for $13.5 billion of the annual revenue, although a 14% growth was observed here too.

Revenue from NVIDIA’s gaming division remained consistent with the previous quarter but rose 56% year-on-year to $2.87 billion. The segment added 15% for the year totalling $10.45 billion, which according to company representatives, resulted from normalized demand following the overproduction crisis, and the successful launch of the GeForce RTX 40 SUPER graphics cards.

Professional visualization solutions marked a 105% increase to $463 million in quarterly revenue, but the annual increase was only 1%. The automotive division saw an 8% sequential increase to $281 million in the fourth quarter, but a 4% decline year-on-year. For the year, the automotive business segment’s revenue increased by 21%, totalling $1.1 billion. The growing demand for NVIDIA components for driver assistance systems contributes to the overall trend.

Company CFO, Colette Kress stated that the demand for current-generation accelerators still exceeds supplies, despite NVIDIA’s active efforts to expand delivery volumes. She predicted that the next-generation B100 accelerators, due for release this year, will also be in short supply. Consequently, the deficit for AI system acceleration components is expected to persist until the end of the year.

Estimates by Huang suggest the server equipment market could double in the next five years, presenting an annual opportunity to increase revenue by hundreds of billions of dollars. The company acknowledged receiving inquiries from antitrust authorities in France, the European Union, the UK, and China regarding its efforts to combat the deficit and normalize prices for its computational accelerators. It is expected more countries will join this list.

Due to positive financial quarter results exceeding analysts’ expectations and an optimistic forecast for the current quarter, NVIDIA stock began to rise even before the new trading session opened. As of press time, the shares were up 9.07% from the closing level, hitting $735.94 per share. Since the start of the year, NVIDIA’s share price has surged 36.25%.