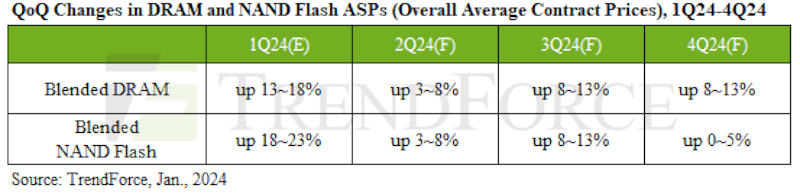

A round of contract prices’ downturn on DRAM, which struck in Q4 2021, finally turned around in Q4 2023. The NAND segment also managed to recover in Q3 2023, following four consecutive quarters of contraction. Analysts at TrendForce anticipate this upward trend to continue, given that manufacturers maintain effective control of their capacity loads.

The season of growth is slated to commence in the first quarter of 2024, according to TrendForce analysts, which confirms their earlier forecasts. They predict a quarter-to-quarter increase in DRAM prices by 13–18% and a rise in NAND prices by 18–23%. Despite the conservatively anticipated demand throughout Q2 2024, memory chip suppliers began to ramp up loads in Q3 2023. It is expected that NAND buyers will finish stocking up ahead of time in Q1 2024, which has led to a more moderate price rise on a quarterly basis, predicting a 3–8% increase for both DRAM and NAND in Q2 2024.

Q3 2024 will mark the traditional peak season, with North American customers resupplying key components more fervently. Contract prices for DRAM and NAND will experience a surge of 8–13%, provided that capacity loads are maintained below 100%. The growing penetration rates of DDR5 and HBM will aid in further enhancing the ASP (Average Selling Price) in the DRAM market.

The overall price growth is expected to persist into Q4 2024, assuming a continued effective production control strategy. The quarter-to-quarter price growth will be at 8–13%, once again propelled by DDR5 and HBM, although a decline in DDR5 indicators is also possible by this point. In other words, the contract price growth in the DRAM segment in 2024 reflects changes in product assortment rather than an overall increase across all DRAM chips. Contract prices for NAND in Q4 2024 are projected to grow by 0–5% compared to the previous quarter.